There is perhaps no better litmus test of investor confidence and resolve than in a crisis, and so it is true of the current COVID-19 pandemic. Even more challenging is maintaining resolve with investments designed to pursue both financial and environmental, social and governance (ESG) objectives as well.

Indeed, over the past several years, ESG has increasingly become an important consideration in portfolio construction. Once considered a niche market tailored to “values-based” or “socially responsible” investors, the market for ESG-linked investments has grown, with top-scoring ESG companies presumed to be better equipped to deal with anticipated and unexpected risks, such as today’s COVID-19 global pandemic. The number of ESG-focused indexes have also grown as well, as evidenced by the launch of ESG-focused equity indexes such as the MSCI AC Asia ESG Leaders Index (launched in 2013) and ESG-focused fixed income indexes, such as the Bloomberg Barclays MSCI US Aggregate ESG Choice Bond Index (launched in 2018).

In this article, we track the performance of ESG-focused investments across geographies and asset classes during the two significant crises—the Global Financial Crisis (GFC) of 2008, and the ongoing COVID-19 pandemic—and explore if they have been resilient through the crises. Where index data was not available, we examine the total returns from Exchange-Traded Funds (ETFs) which track ESG and their parent indexes.1

ESG-Focused Equity Performed Well in the COVID-19 Period to Date

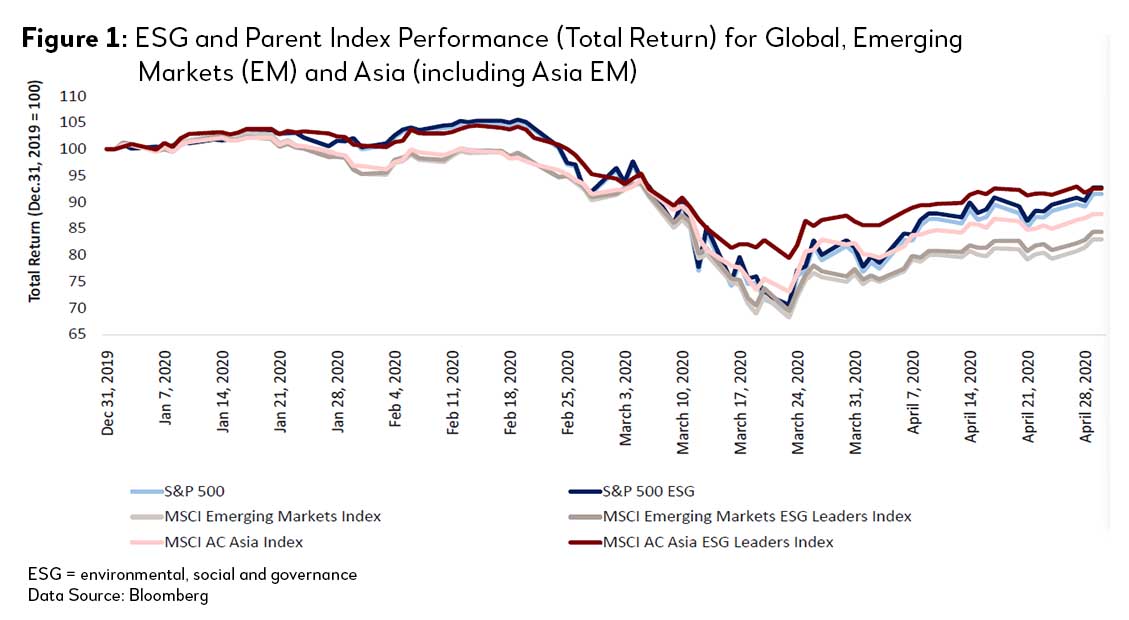

Many articles have explored the resilience of ESG-focused indexes and ETFs over the COVID-19 period to date,2 citing reasons such as the correlation of ESG scores with a corporate’s ability to effectively manage risks, from supply chain disruptions to corporate governance risks.3 Since the start of the pandemic, the S&P 500 ESG Index, the MSCI Emerging Markets ESG Leaders Index, and the more Asia-focused MSCI AC Asia ESG Leaders Index have all performed better than their parent indexes by +0.6 percent, +0.5 percent and +3.83 percent respectively on a total return basis (Figure 1).

That ESG-focused equities have displayed resilience in both developed and emerging markets is notable; global investors had expected emerging markets to be more affected by the COVID-19 global pandemic, as capital was expected to exit emerging markets in the flight to safety.4

The long-term mindset could be a key explanation why ESG-focused assets do not suffer from “capital drain” during a “short-term” crisis. Perhaps more importantly, this shows the potential of ESG as a benchmark for financial resilience.

But a More Mixed Picture for ESG-Focused Debt

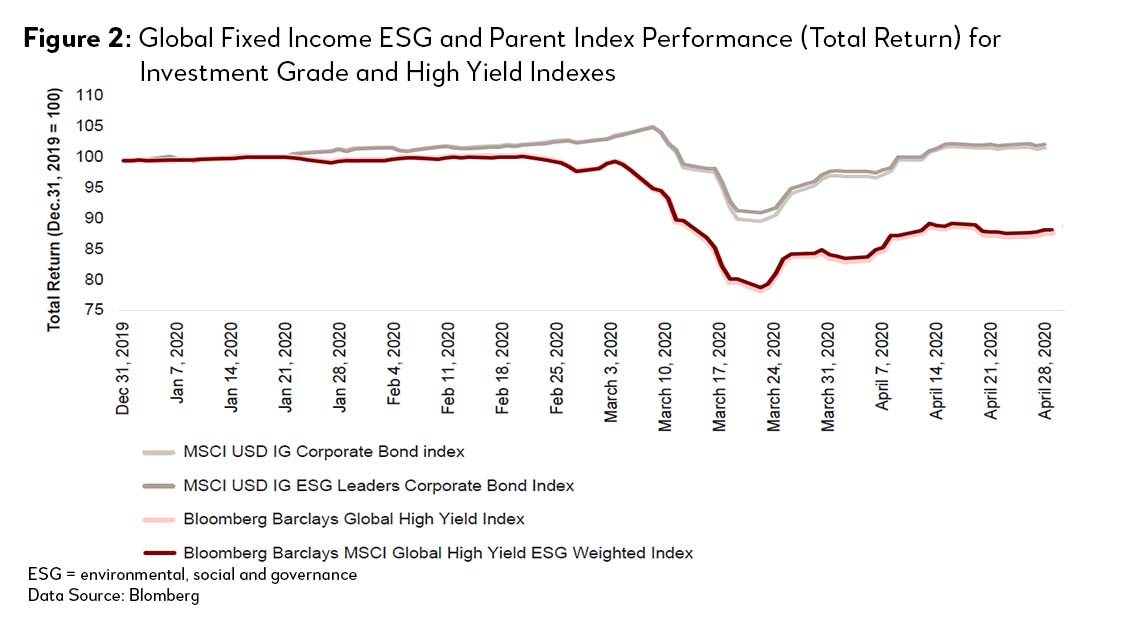

With respect to ESG-focused fixed income investments, resilience relative to vanilla fixed income indexes has also been observed.

Looking first at developed markets, since the start of the pandemic, ESG-focused investment grade and high yield indexes have performed broadly in line with their parent indexes by +0.22 percent and +0.13 percent respectively (Figure 2).

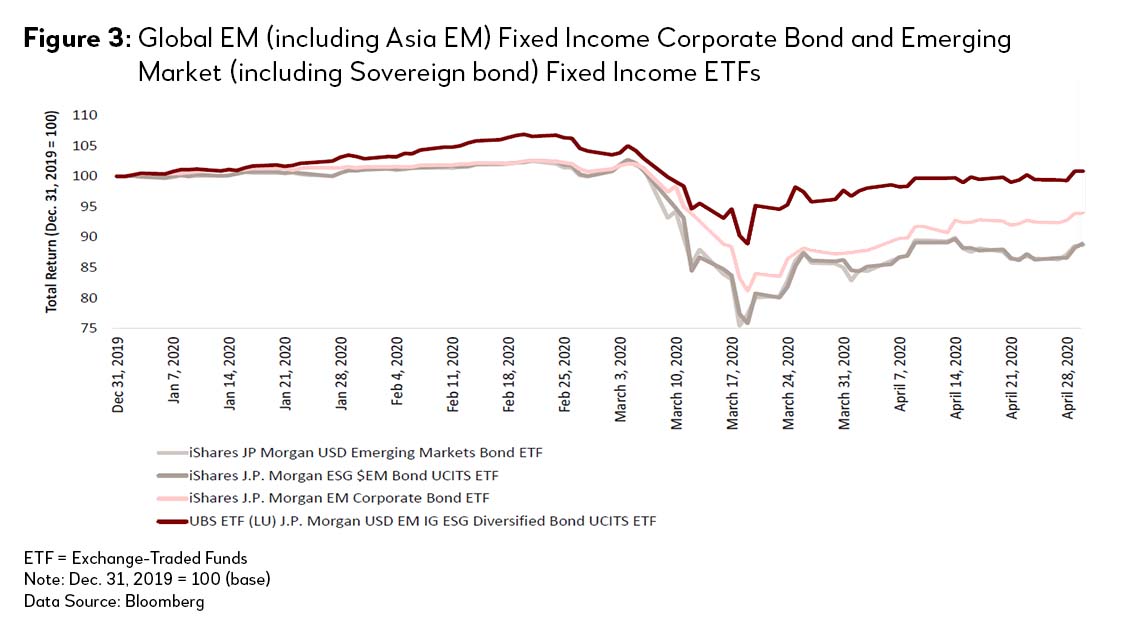

Turning to developing markets, where index data was not available, we examined the total returns from ETFs which track ESG and their parent indexes. We looked at four ETFs that track the JP Morgan Emerging Market Bond Index (EMBI), its ESG counterpart (JESG EMBI), the JP Morgan Corporate Emerging Market Bond Index series (CEMBI) and a combination of securities from the JESG CEMBI and JESG EMBI Index. In the same order, these are the iShares J.P. Morgan USD Emerging Markets Bond ETF, iShares J.P. Morgan ESG EM Bond ETF, iShares J.P. Morgan EM Corporate Bond ETF, UBS ETF J.P. Morgan USD EM IG ESG Diversified Bond UCITS ETF.

We highlight two key observations (Figure 3):

- Sovereign bond-dominated ESG ETF (dark grey) showed only a marginal +0.14 percent increase in performance over its non-ESG counterpart (light grey).

- The mixed corporate and sovereign ESG EM Bond ETF (red) had better performance as compared to its non-ESG corporate bond counterpart (pink, +4.26 percent) and its mainly sovereign bond-dominated non-ESG counterpart (light grey, +4.40 percent).

In other words, there is some evidence that investors do not distinguish between sovereign ESG bonds and sovereign non-ESG bonds. This is perhaps because investors see sovereign issuances as one and the same (i.e., issuances and funds raised are perceived to be highly fungible) and therefore disregard any ESG labels. But investors do make a distinction between corporate ESG versus non-ESG bonds. ESG certification is thus of a higher value to corporates, as opposed to sovereigns, as investors do distinguish between corporates. Corporate ESG bonds also performed better than sovereign ones. This might reflect increased investor confidence in emerging market corporate bonds over the last few years, coinciding with the growth of capital markets in such regions.5

In general, for fixed income assets, identifying resilience factors may not be so straightforward due to its different risk-return profile from equities. In a global crisis such as the COVID-19 pandemic, investors may generally seek “safety” in sovereign and corporate debt regardless of its ESG label, resulting in a capital increase to debt capital markets in general.

Volatility Over the COVID-19 Period

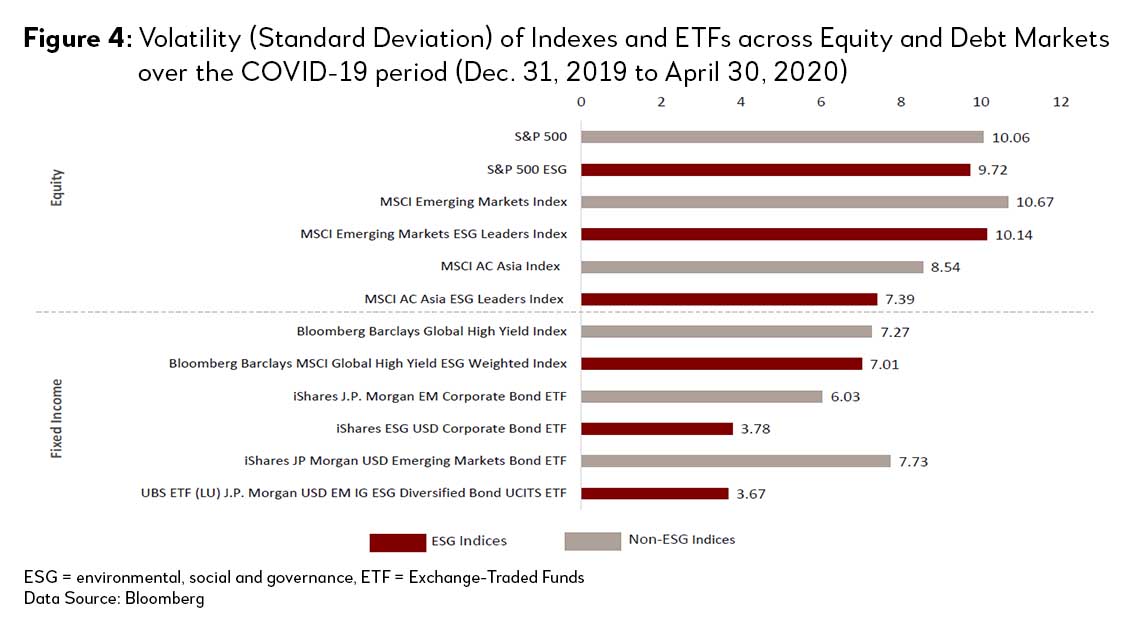

Besides total return, we also looked at the volatility of ESG-focused assets over the COVID-19 period. We observe that across geographies and asset classes, ESG indexes and ETFs have displayed less volatility as compared to their non-ESG benchmark counterparts (Figure 4) over the COVID-19 period.

Many ESG indices and their tracking ETFs, by virtue of selecting companies that are high ESG performers within their sector, reduce their exposure to companies that have high emissions or that are heavily exposed to fossil fuels (these companies would likely score poorly on the “E” dimension). Moreover, such companies (e.g., airlines, companies in the oil sector) are currently disproportionally impacted by the combined impact of COVID-19 (in light of lockdowns and restrictions in movements) and the weak oil price environment.

ESG-Focused Indexes during the Global Financial Crisis

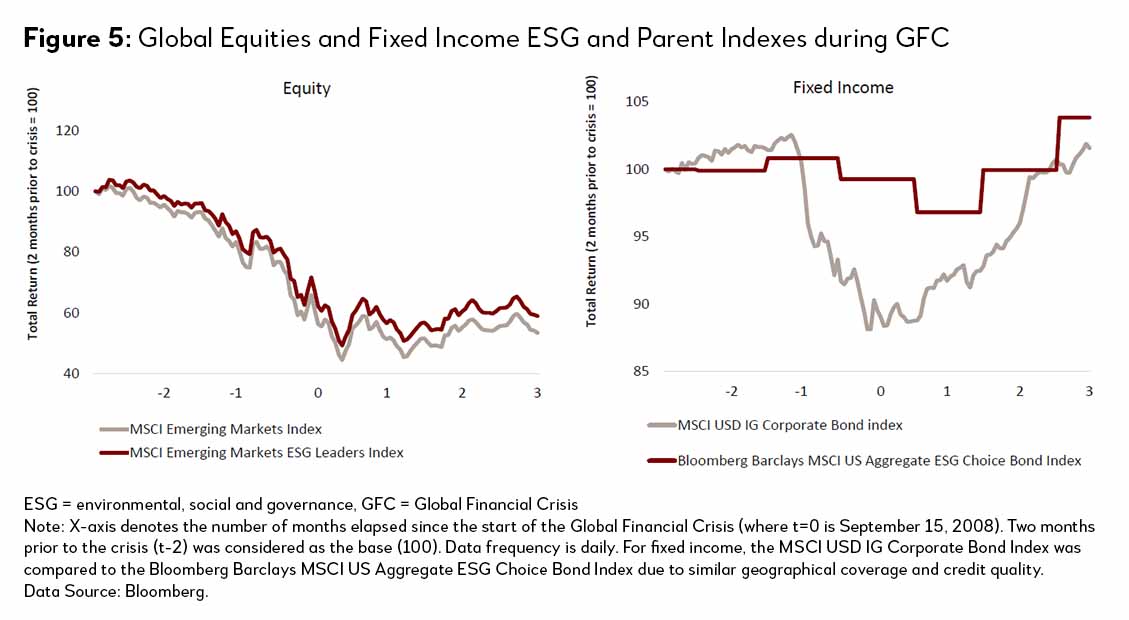

Is the good performance of ESG assets during the COVID-19 period a one-off event? With back-dated index and ETF data, we explore how selected equity and fixed income indexes could have performed if they were available during the time of a different global crisis, the 2008-2009 Global Financial Crisis (GFC).

Taking into consideration data availability, Figure 5 shows the total returns of equity and fixed income indexes in the two months prior to and the three months after the onset of the GFC. Here, we observe similar trends as in the COVID-19 period: resilience of ESG-focused investments during this period.

Explanations for the Resilience of ESG-focused Investments

Taking into account all of the above observations, the greater resilience of ESG-focused indexes and ETFs across the equity and debt capital markets may be due to several factors.

First, it may be connected to how indexes are constructed. Most indexes are constructed by a selection of securities by market cap and sector, causing higher representation of companies in the financial, technology, consumer and health care sectors in ESG indexes, and lower representation of resource-intensive sectors such as energy and materials which generally were hard hit in a combination of the COVID-19 and the oil-price shock period. Furthermore, during the COVID-19 pandemic, movement and transportation was severely restricted. This benefitted companies that supported virtual interactions (e.g., e-commerce technology6) but was detrimental to transport and logistic-heavy sectors such as the oil sector, which suffered from halted production and restrictions in movement.

Second, ESG selection bias may exist due to a lack of standardized and mandated ESG reporting. Therefore, companies that already have a large enough resource base dedicated to measuring and disclosing ESG performance could end up with a higher ESG score.

Looking Ahead

Based on the above observations, should ESG-focused investments be considered a “safe haven” in times of crises? While we have provided some observations and offered explanations on the resilience of ESG-focused investments, further detailed analysis (e.g., effect of materiality of ESG sub-issues versus other variables like momentum) should be done to pinpoint the drivers of good performance.

Toward this end, the Asian Infrastructure Investment Bank (AIIB) is committed to catalyzing the creation of sustainable capital markets through its Sustainable Capital Markets Initiative.7 Under this initiative, one of its first portfolios is the Asia ESG Enhanced Credit Managed Portfolio which aims to develop debt capital markets for infrastructure in Emerging Asia with a strong ESG rationale in security selection and corporate engagement.8

If the COVID-19 crisis had a silver lining, this could be the proof-of-concept that an ESG investment strategy would mean maximizing impact while minimizing risk and under-performance across asset classes, even in emerging markets, where capital can go a long way in doing well and doing good.

1 For high-ESG scored investments, we follow the definition from index and ETF providers. For most ESG indexes and their tracking ETFs, constituents are defined to exhibit good ESG qualities in two broad manners: 1) issuers that have high ESG scores relative to their sector peers, or 2) re-weighting of indexes to increase exposure to companies that have a positive trend in improving their ESG score. The selection of the ETFs for this article followed a sample methodology where an optimized subset of securities from the benchmark index was used to track benchmark index performance.

2 See I. Young. 2020. MSCI ESG indexes outperform during COVID-19 pandemic in Q1 2020. ETF Trends. (April 27). https://www.etftrends.com/msci-esg-indexes-outperform-during-covid-19/; J. Hale. 2020. Sustainable funds weather the first quarter better than conventional funds. Morningstar. (April 3). https://www.morningstar.com/articles/976361/sustainable-funds-endure-the-first-quarter-better-than-conventional-funds

3 L. Moon. 2020. Coronavirus strengthens case for sustainable investing as ESG stocks outperform market in crisis. South China Morning Post. (May 1). https://www.scmp.com/business/companies/article/3082499/coronavirus-strengthens-case-sustainable-investing-esg-stocks

4 S. Minerd. The emerging emerging-markets crisis. Seeking Alpha. (April 13). https://seekingalpha.com/article/4337341-emerging-emerging-markets-crisis.

5 Incisive Media. 2020. Favourable conditions for corporate bond performance. https://www.investmentweek.co.uk/investment-week/news/1366474/favourable-conditions-corporate-bond-performance

6 A. Ong Lopez, A. Sen Gupta and J. Su. 2020. Bringing e-commerce to high speed via good ground infrastructure and logistics. Asian Infrastructure Investment Bank. (April 30). https://www.aiib.org/en/news-events/media-center/blog/2020/Bringing-E-Commerce-to-High-Speed-via-Good-Ground-Infrastructure-and-Logistics.html.

7 C. Lowrance. 2019. The rise of sustainable capital markets. Asian Infrastructure Investment Bank. (July 12). https://www.aiib.org/en/news-events/media-center/blog/2019/The-Rise-of-Sustainable-Capital-Markets.html

8 Asian Infrastructure Investment Bank. Multicountry: AIIB Asia ESG Enhanced Credit Managed Portfolio. https://www.aiib.org/en/projects/details/2018/approved/Multicountry-AIIB-Asia-ESG-Enhanced-Credit-Managed-Portfolio.html.