COVID-19 Pandemic Altering Consumer Behavior

As concerns over the spread of the COVID-19 pandemic peaked across different countries in late-February and early-March 2020 and trips to brick and mortar stores were curtailed, e-commerce sales experienced a significant acceleration. Weekly average sales of fast-moving consumer goods (FMCG) online over this period were found to be significantly higher across many OECD countries—Italy (82 percent), France (87 percent), Spain (62 percent) and Australia (42 percent)—compared to a year back.1 In the United States, sales of consumer-packaged goods in the first two weeks of March were 29 percent and 91 percent higher compared to a year back. In East Asian economies like China and the Republic of Korea which also had to restrict movements to counter the spread of COVID-19, online sale of FMCG products was already an established preference, especially among the young. However, during the COVID-19 period, a sharp growth in orders placed by older users was also observed. According to an online survey, in February and March 2020, 67 percent to 73 percent of internet users in Malaysia, Thailand, Singapore and Philippines avoided crowded places, which likely included malls and other marketplaces, to protect themselves from COVID-19.2

Even across many developing countries outside of East and South East Asia, where internet penetration is low, a surge in online purchases was observed in the second half of March, especially for personal hygiene products and essential groceries. For example, in India, e-commerce sales of staples, snacks and processed foods in March 2020 were 16 percent to 104 percent higher compared to February 2020.3 In Türkiye, some of the retailers also experienced up to 50 percent increase in their weekly turnover on their digital platforms in March 2020, compared to February 2020.

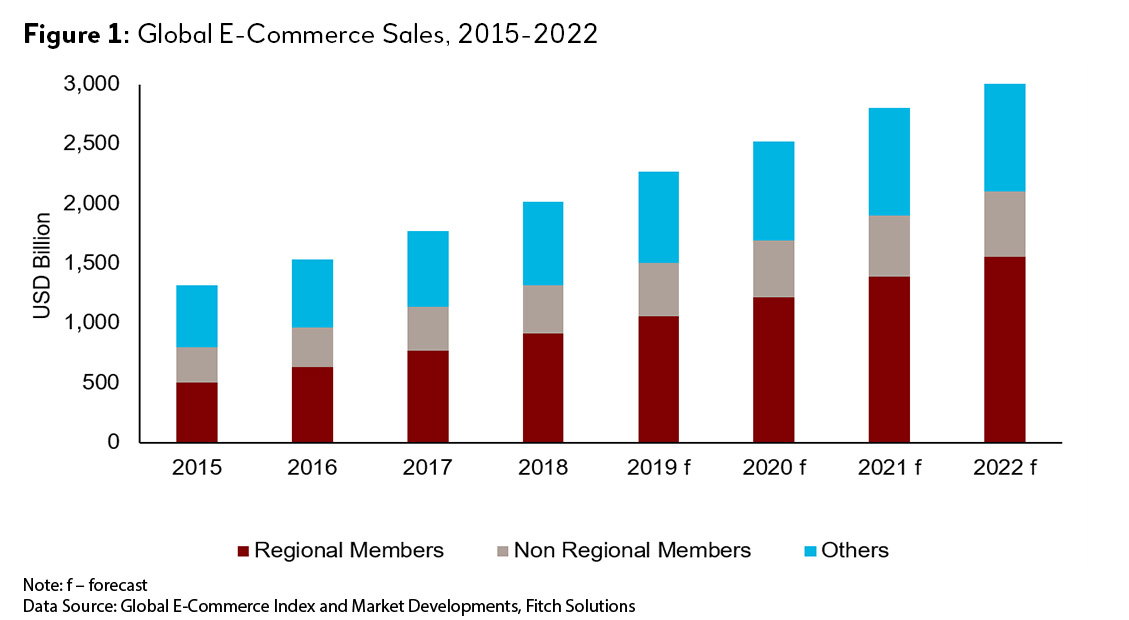

This boom in e-commerce sales is not surprising. Consumers globally have been increasingly using online platforms for purchasing a diverse set of goods and services. According to Fitch Solutions, between 2015 and 2018, e-commerce sales grew annually at an astonishing rate of 15.3 percent, more than three times the growth of global GDP (Figure 1).4 While historically, OECD countries like the United States, Japan, Germany and United Kingdom used to account for most of e-commerce sales, in recent years, emerging markets, including a number of AIIB regional members like China, India, Russia and the United Arab Emirates, have become important e-commerce markets. COVID-19 has accelerated these trends.

Disparate Impact on the E-commerce Universe

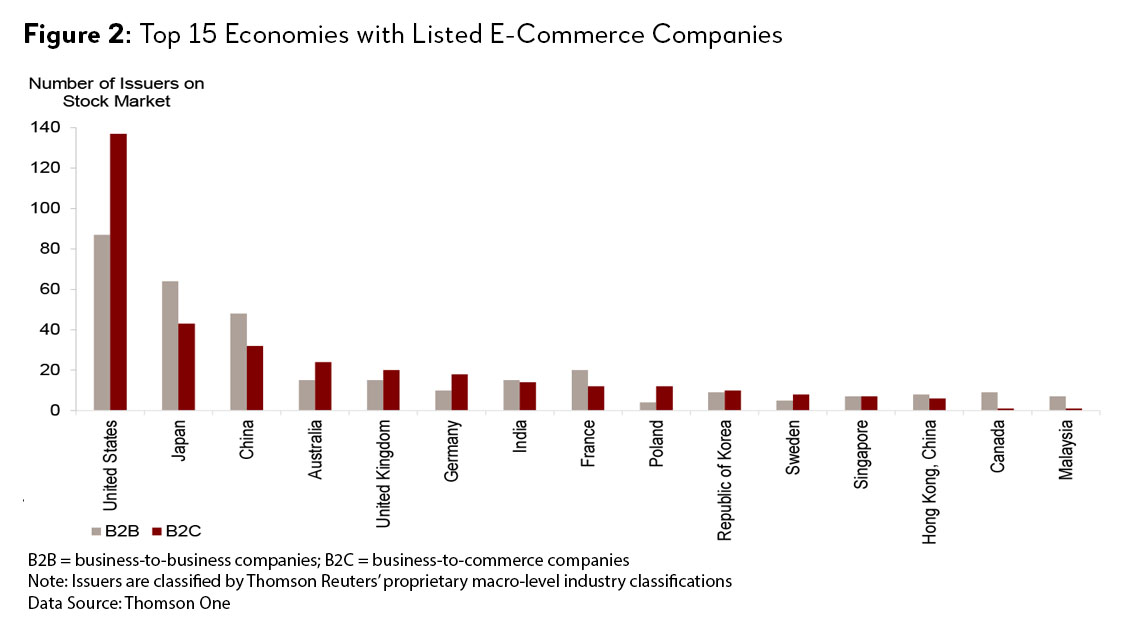

Despite the bullish outlook, e-commerce operations remain largely concentrated in developed markets. In fact, most business-to-commerce (B2C) companies operate in developed markets like the United States, Japan, Australia, United Kingdom, France and Germany. China and India are the only emerging countries to figure in the top 10 countries with the most B2C companies (Figure 2), largely due to them being large consumer markets. The same is true for business-to-business (B2B) companies. The failure of developing markets to develop a bigger e-commerce foothold is disappointing, given e-commerce’s potential to contribute to job creation and potentially offset jobs decline in brick and mortar stores during this pandemic. Some platforms, for example, are looking to hire new workers in efforts to meet increased consumer demand5 or expand operations.6

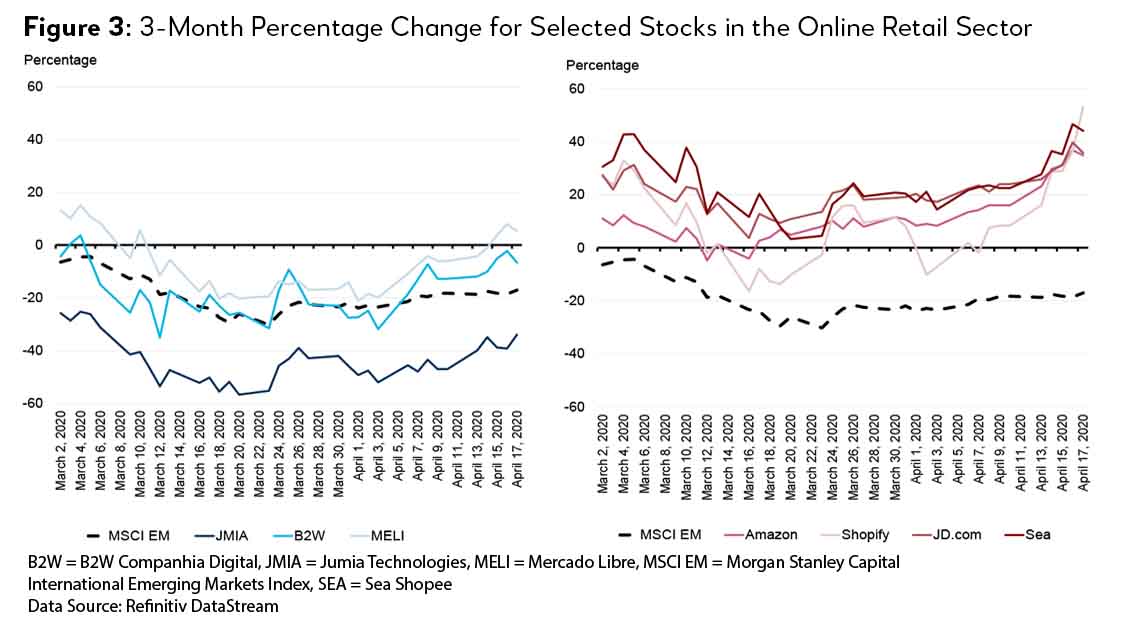

Moreover, not all e-commerce companies are likely to have benefitted during the ongoing crisis. If we use movement in stock prices of e-commerce companies as a proxy for investors’ perception about the potential of that company, we find that e-commerce platforms operating in developing markets are generally lagging behind those operating in developed markets (Figure 3). For example, over the period between February 3 to April 17, 2020, the growth in stock market prices for leading platforms in developing markets like Jumia Technologies (JMIA) (Africa), B2W Companhia Digital (B2W) (Brazil), and Mercado Libre (MELI) (Latin America) performed at par or worse than the MSCI Emerging Markets index, in contrast to stock prices for Amazon (United States), Shopify (Canada), JingDong (China) and Sea Shopee (Southeast Asia), albeit the last two are emerging market outliers.

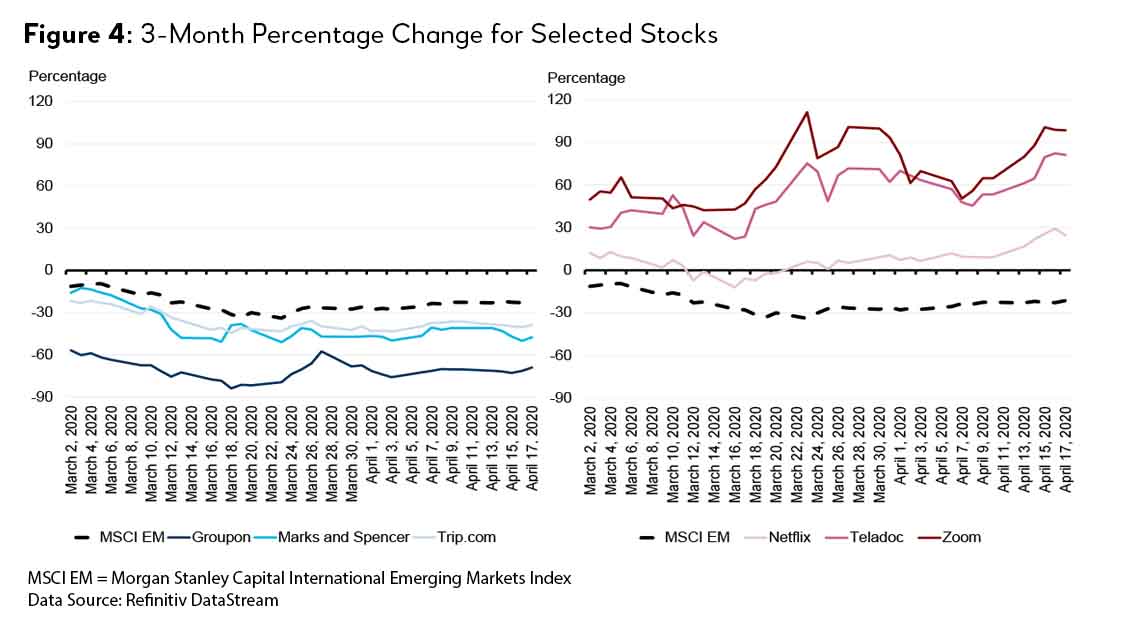

In addition to spatial variation, the onset of COVID-19 pandemic and the resulting lockdown are also reflected in the varying performance of companies, depending on the nature of the e-commerce vertical in which they operate (Figure 4). Generally, companies which engage in activities that involve visiting places and are antithetical to social distancing and lockdown measures, such as Groupon (which connects merchants and customers by offering activities, and thus depends on people turning up for yoga classes and eating at restaurants) and Trip.com (which depends on people buying tickets to physically visit tourism sites) saw their stock prices slide. Likewise, companies serving a particular segment, such as clothing (e.g. Marks and Spencer and Neiman Marcus7) are not doing well as people defer their discretionary spending.

In contrast, companies that are providing services that are helping people maintain social distancing and allow virtual interactions, like Teladoc, an online virtual health consultation provider, and Zoom, an online virtual meeting place, have performed significantly well. Netflix, a popular online streaming company, has also seen its share prices inching up in recent weeks.

Factors Affecting Delivery of E-Commerce Services

A likely factor for the diverse performance of companies operating in different parts of the world is the widely differing extent of supply chain disruptions, and varying quality of logistics infrastructure. The success of e-commerce is contingent on the company’s ability to smoothly transport goods and services to the consumer. Well-functioning road and rail systems for freight transportation, warehousing, ports and border clearance and last mile delivery helps reduce the costs of firms engaging in e-commerce. The quality of logistic infrastructure varies widely across economies and it is no surprise that developing markets lack adequate logistics infrastructure.

For example, according to the World Economic Forum,8 road infrastructure quality varied from 74 out of 100 in high-income countries to 49 out of 100 in low-income countries. There is also a lot of spatial variation with Europe and North America having the highest score (72 out of 100) followed by East Asia (66), while Sub-Saharan Africa had the lowest score (53). Latin America did not score that well either, at just 56 out of 100. Between countries, developed markets such as Singapore tops the global road quality ranking out of 141 countries (scoring 91 out of 100). Countries such as United States and Canada come close at 5th and 17th (scoring 87 and 83 respectively). Among developing markets, China ranks quite high at 24th (scoring 78 out of 100), compared to Brazil (93rd, scoring 55) and Nigeria (105th, scoring 51).

To be able to access e-commerce services, a complementary but prerequisite infrastructure is digital infrastructure. Again, however, developed economies tend to outperform developing economies in this metric. Comparing digital infrastructure performance between income groups, the latest data from the International Telecommunication Union9 shows that 35 percent of individuals in high-income countries have access to fixed broadband, compared with less than 1 percent for those in low-income countries. Besides, 125 percent of citizens living in high-income countries have access to mobile phones compared to 88 percent for those living in low-income countries. This suggests that high-income countries own more than one phone for every individual, while those in low-income countries have less than one, hinting that the poor may have to share mobile devices. This may also indicate that the poor’s mobile devices are likely unable to access the internet. In fact, only 23 percent could access the internet in low-income countries, compared to 93 percent among high-income countries.

The Way Forward

E-commerce platforms provide an important cushion to government measures to contain the COVID-19 pandemic. Considering lockdowns and social distancing measures, everyday life is less disrupted thanks to the tangible benefits that virtual e-commerce platforms have to offer. Moreover, these platforms can have long-lasting impacts due to their ability to contribute to job creation and growth. However, e-commerce has yet to be a panacea for all. Developing countries are less likely to have access to e-commerce for reasons that are intrinsic to country contexts, including weak logistics and subpar digital infrastructure.

To ensure digital inclusion of underserved people, significant investment in digital technology, including digital infrastructure, is required. According to the Global Infrastructure Outlook, digital infrastructure financing need between 2020 and 2040 is estimated to be around USD6.5 trillion with an investment gap of USD768 billion, with majority of the gap residing within developing countries.10 Therefore, ramping up investment in digital infrastructure is a frontline step towards benefiting from the e-commerce boom. This will need to be accompanied by investment in logistics infrastructure like road and railways, ports and storage to ensure timely delivery of goods and services.

1 COVID-19: The Unexpected Catalyst for Tech Adoption, Nielsen Insights. https://www.nielsen.com/in/en/insights/article/2020/covid-19-the-unexpected-catalyst-for-tech-adoption/.

2 COVID-19 Concerns May Boost Ecommerce as Consumers Avoid Stores: How Stock Shortages and Supply Chain Issues Impact Digital Advertisers. https://www.emarketer.com/content/coronavirus-covid19-boost-ecommerce-stores-amazon-retail.

3 COVID-19: Impact on Indian FMCG and Retail, Nielsen.

4 E-commerce is a generic term for which there is no uniform definition. Consequently, the estimates of e-commerce market vary widely across studies depending on which aspects of e-commerce are included.

5 CNN. (April 2020). Amazon is hiring 75,000 more workers to keep up with demand during pandemic. https://edition.cnn.com/2020/04/13/tech/amazon-hiring-coronavirus/index.html.

6 Financial Times. (April 2020). ByteDance looks to hire 10,000 thanks to TikTok boom. https://www.ft.com/content/0fca293c-5d11-4462-a7d2-52977d8bdbd2.

7 As of April 2020, it was reported that Neiman Marcus could be filing for bankruptcy as a result of losses due to the COVID-19 pandemic. See https://www.cnbc.com/2020/04/24/neiman-marcus-eyes-sunday-bankruptcy-filing-600-million-emergency-funding.html.

and https://www.reuters.com/article/us-neimanmarcus-bankruptcy-exclusive/exclusive-neiman-marcus-to-file-for-bankruptcy-as-soon-as-this-week-sources-idUSKBN2210CW.

8 World Economic Forum (2019) The Global Competitiveness Index 4.0 2019 Dataset. http://reports.weforum.org/global-competitiveness-report-2019/downloads/.

9 International Telecommunication Union Database, last accessed on March 31f, 2020. https://www.itu.int/.

10 Based on the 2018 Global Infrastructure Outlook, Oxford Economics and Global Infrastructure Hub. https://outlook.gihub.org/.