Globally, the corporate sector is raising record amounts of cash through the bond market during the pandemic

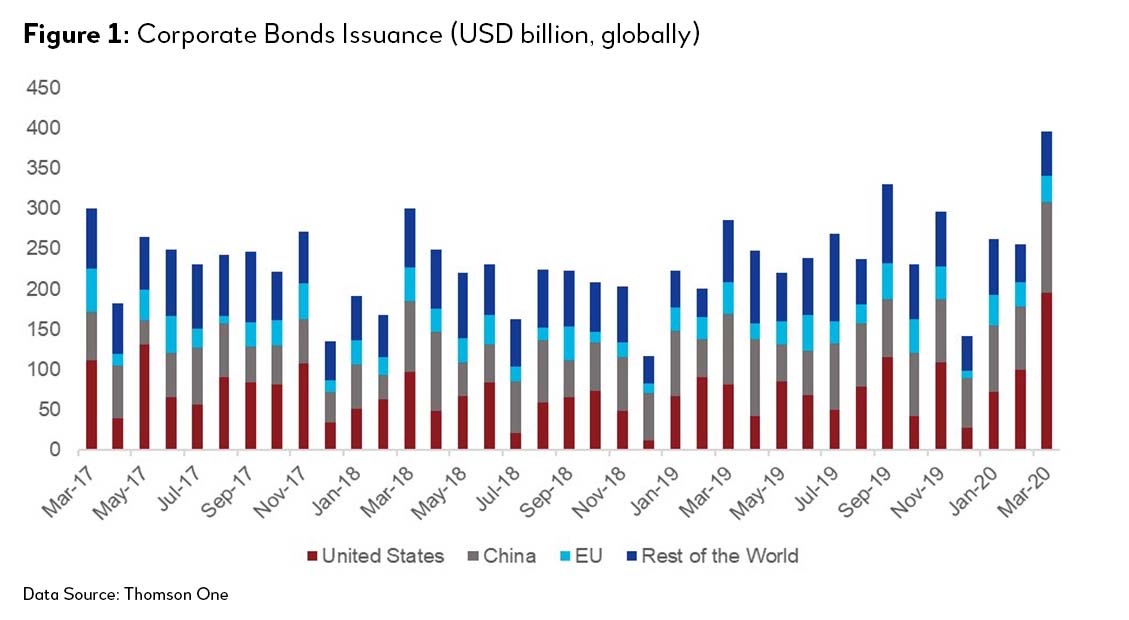

As the scale of the new coronavirus pandemic and potential economic disruptions became more evident throughout the first quarter of 2020, companies rushed to secure liquidity by raising cash, drawing credit lines as well as going full steam ahead with bond issuances. Global bond issuance has surged in Q1 2020. According to data from Thomson Reuters, global corporate bond issuance increased to USD914 billion in the first quarter of 2020, up 29 percent compared with the same quarter of 2019.1 Issuance by US corporations amounted to USD366 billion, followed by China with USD274 billion bonds issued. March was a particularly active month, with a record issuance of USD396 billion, which is double the typical monthly issuance seen over the past years.

During such uncertainty, it is rational for companies to build up a war chest of liquidity for the stormy times ahead. This may, in fact, be a matter of survival. How did the infrastructure sector fare in this race to liquidity? How about Asian corporates?

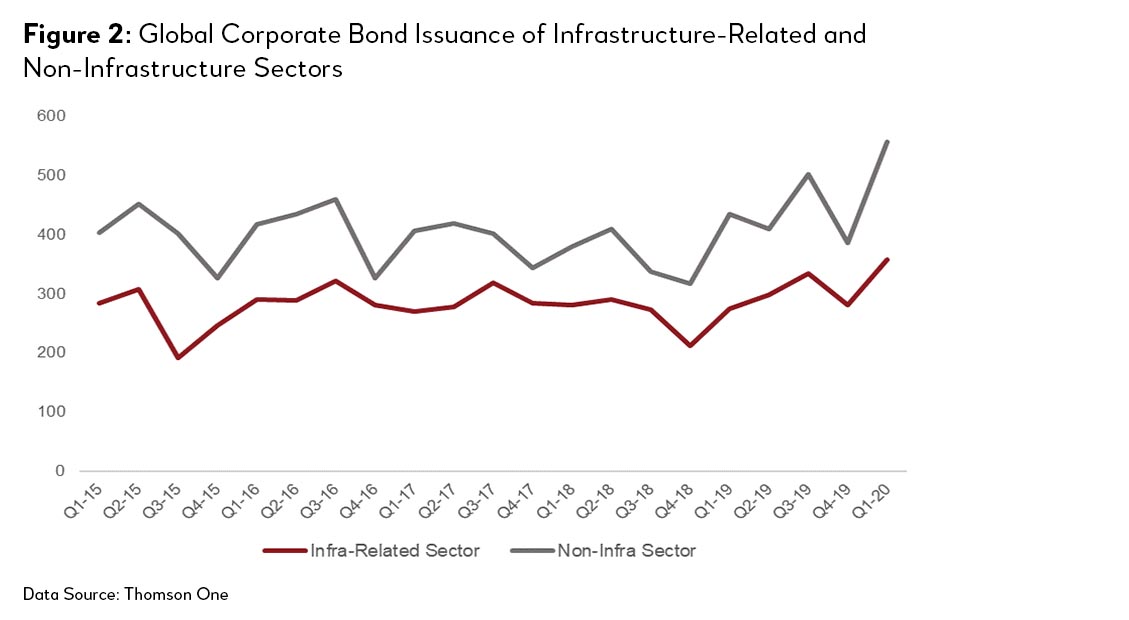

Infrastructure-related sectors took equal part in this bond rush

Companies in the infrastructure-related sector also saw a record amount of new bonds issued in the first quarter; at USD357 billion, the issuance was 30 percent higher than in the same quarter of 2019. The telecommunications sector (including telecom equipment and services, as well as wireless) saw a particularly large 46 percent increase (to USD55 billion). US telecom service providers, such as Verizon, are issuing bonds to support 5G-related projects. Investment in telecom infrastructure has been less affected than other sectors during the pandemic as leading service providers continue to build their 5G networks.2,3

On a related note, globally, issuance for high yield (“non-investment grade”) bonds dropped significantly to USD3.9 billion in March, only one-eighth of the usual level, highlighting investors’ preference for quality in times like these. March saw only three high yield bond issuances in the US (USD2.9 billion) and no issuance in the EU. For China, the drop began in February when issuance declined more than 70 percent year on year.

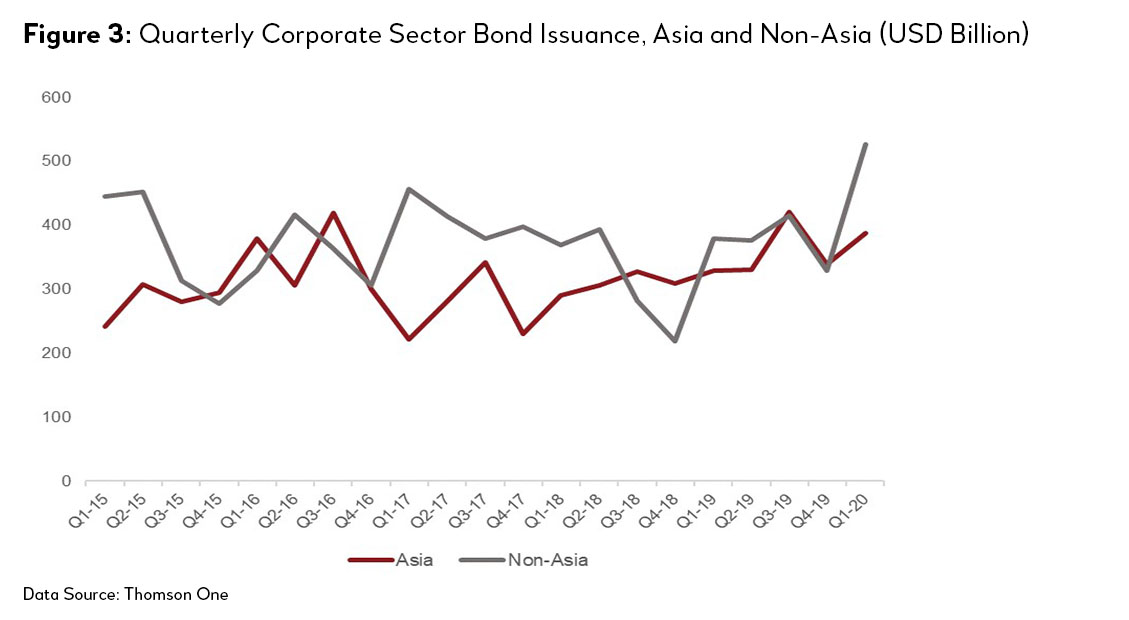

Meanwhile, companies in Asia did not tap the market to the same extent as firms elsewhere

Some USD387 billion bonds were issued by Asian corporations in the first quarter, up 17 percent from 2019, but below previous peaks. China and Japan accounted for almost 90 percent of the total issuance. Outside Asia, the corporate sector saw a greater increase in bond issuance during the pandemic—almost 38 percent from 2019, to USD527 billion, which is a record amount for the past five years.

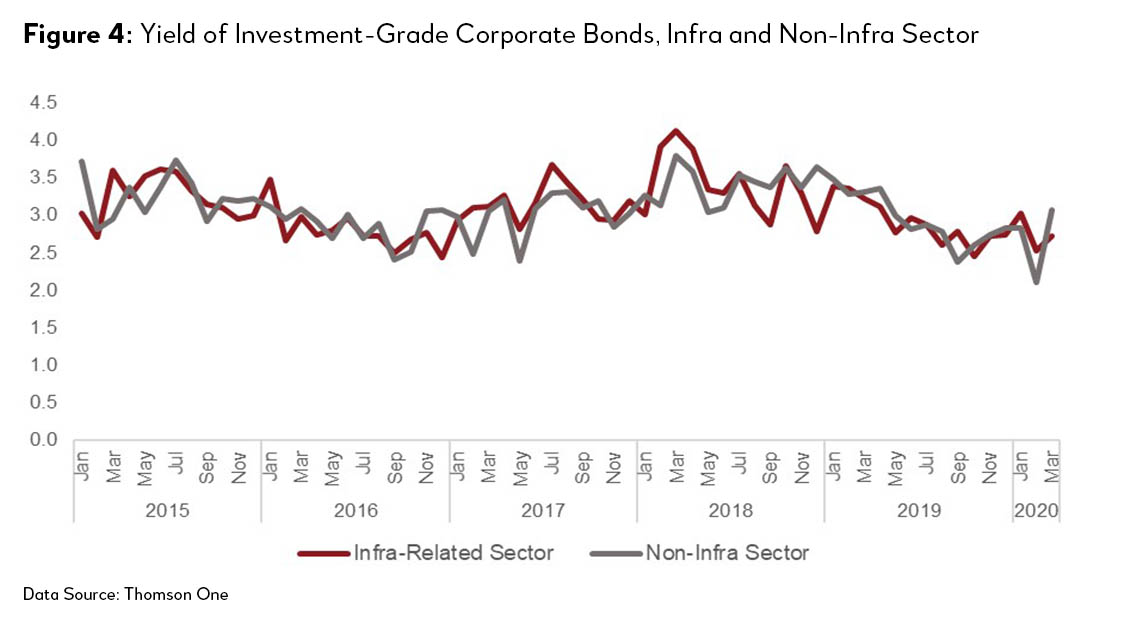

Borrowing cost rose, but less for infrastructure-related sectors

Borrowing cost increased during the pandemic. Average yield-to-maturity for investment-grade corporate bonds rose to almost 3 percent in March, up from 2.27 percent in February. Spreads to respective benchmarks nearly doubled in March, reaching 144 basis points on average. The cost increase has been relatively benign for firms in the infrastructure-related sectors, where yields increased by only 20 basis points (from 2.53 percent to 2.73 percent). On average, bond tenors fell slightly—from 8.3 years to 7.7 years between February and March—but increased for the infrastructure-related sectors, from 7.7 years to 8.5 years.

Summary and Implications

The good news is that corporates are still able to tap the capital markets despite the macroeconomic and stock market volatility. Borrowing cost rose, but not prohibitively so, at least for the investment-grade companies. Record issuance amounts and the relatively muted impact on borrowing costs appears to be a vote of confidence by market participants in the recent extraordinary support measures taken by world’s leading central banks, including a promise by the US Federal Reserve (Fed) to purchase corporate bonds.

There is more to come, judging from the record-high volume of requests for new corporate debt identifiers (which are needed to issue a financial instrument in the US market)—these are up some 14 percent from Q1 2019 for US and Canada corporates, and over 20 percent for international debt.4 The capital market is bracing for another busy quarter in corporate bonds issuance.

China corporates were able to tap the capital markets, even during the pandemic. This is also consistent with our earlier analysis that China remains attractive to investors.5 The implication here is that there would be sufficient liquidity for corporates to tide them through the crisis or even to position themselves for investments post-crisis. The fact that the telecommunications sector had a strong showing is particularly interesting. This is not a crisis-affected sector—in fact, quite the opposite, given the reliance on ICT during the pandemic. There could be a real spark for ICT investment post-crisis.

Alas, corporate bond markets are not developed in Asia outside of Japan and China. This is not a new fact, but the pandemic episode underscores the fact that the companies in developing economies in Asia do not have sufficient access to capital market financing. Total bond issuance in Q1 2020 declined by about 25 percent compared with the same period in 2019, for both investment-grade and lower-rated companies alike. Multilateral development banks and international financial institutions thus have an important role in channeling finance to these developing economies.

Even before the current global health crisis, corporate debt around the world had reached heights never seen before, as companies maximized their leverage, taking advantage of the ultra-low interest rates environment over the past decade. The Fed’s promise to purchase corporate bonds and the ample savings being generated by the household sector that is not spending because of lockdowns have been helping corporations to weather the storm so far, but we may literally be living on borrowed time. The key remains to get past the lockdown phase as quickly and efficiently as possible, and for economies to restart.

1 Excludes bonds issued by governments or financial institutions.

2 See Fitch Ratings (April 2020). Coronavirus unlikely to delay US 5G wireless spending. https://www.fitchratings.com/research/corporate-finance/coronavirus-unlikely-to-delay-us-5g-wireless-network-spending-02-04-2020.

3 See Korean Times (March 2020). https://www.koreatimes.co.kr/www/tech/2020/03/133_285715.html.

4 PRN News Wire (2 April 2020). Corporate borrowers ramp up access to liquidity with surge in new CUSIP requests. https://www.prnewswire.com/news-releases/corporate-borrowers-ramp-up-access-to-liquidity-with-surge-in-new-cusip-requests-301034966.html.

5 See AIIB blog (10 April 2020) China’s Economy Recovering; Global COVID-19 Efforts Needed. https://www.aiib.org/en/news-events/media-center/blog/2020/China-Economy-Recovering-Global-COVID-19-Efforts-Needed.html.