The world’s multilateral development banks (MDBs) are getting serious about working together to achieve impact. In the fall of 2023 in Marrakech, the heads of 10 MDBs, including ours, agreed on a path forward (“Strengthening Our Collaboration for Greater Impact,” pictured above) with five specific elements. This month in Washington, D.C., they reaffirmed their commitment and began to turn words to deeds.

MDBs are making measurable progress in the joint interest of maximizing their impact as a system. Yet the collaboration among MDBs is only one avenue of several possibilities to leverage impact. Another is MDBs’ collaboration with Sovereign Wealth Funds (SWFs).

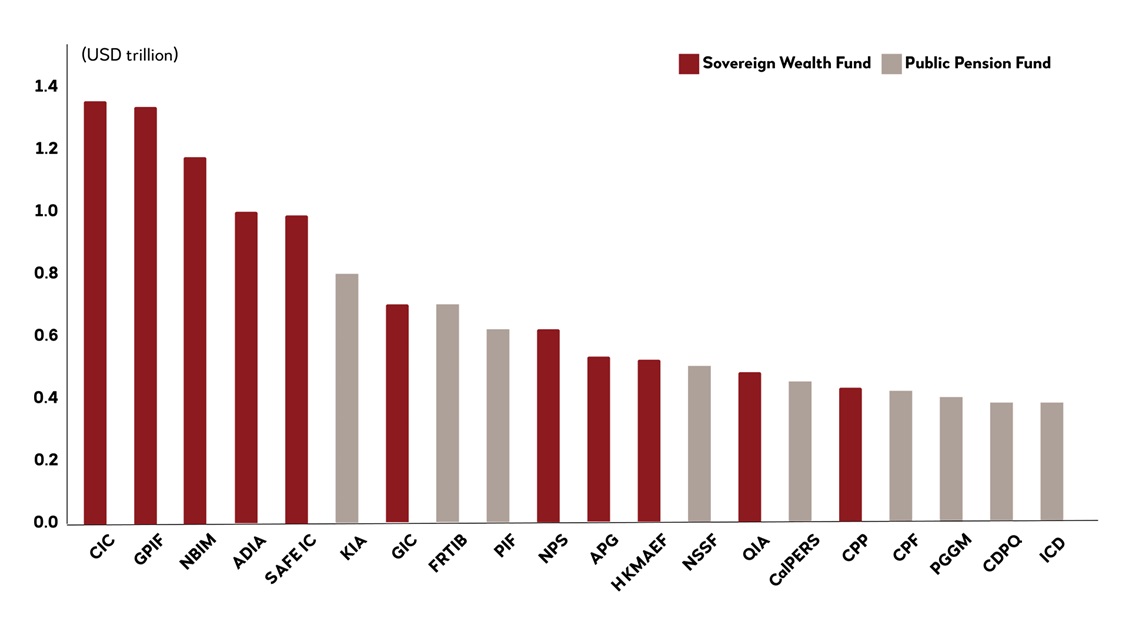

Because MDBs and SWFs share a role of being entrusted as custodians of public funds, the areas of collaboration identified in Marrakech apply equally in the partnerships between the two types of organizations, despite their inherent differences. Considering that SWFs and public pension funds managed over USD30 trillion of assets as of 2022, according to Global SWF, it is clear that even a fraction of those resources will have a dramatic impact wherever they are directed.

AIIB has been partnering with SWFs to channel resources directly into projects. In fact, AIIB has had SWF investments in nine of its projects to date; the Asia Investment Fund is an example. Yet the five critical areas identified in Marrakech—regarding financing capacity, joint action on climate, country-level collaboration, cofinancing and private-sector engagement—illustrate how partnership with SWFs can be broader.

Let me share a few ideas I picked up while reading a study titled “Sustainable Investing by State-Owned Investors: International Practices and Policy Recommendations,” published in August 2023 by the China Council for International Cooperation on Environment and Development (CCICED).

CCICED is a body with an internationally appointed Executive Committee and a Council of more than 80 international experts, including my AIIB colleague Sir Danny Alexander, Vice President of Policy and Strategy. One comment that struck me in the study is that every one percent of total assets under management (AUM) of all state-owned investors invested in climate change sectors equals 3.7 times the current total of all climate commitments of all MDBs. The prize to involve SWFs across the MDB collaboration areas is irresistible, and achievable. AIIB and its peers are already engaging SWFs and the effort is aided by a high concentration of funds that are managing the resources. Consider the AUM reported by fund in the chart below.

A second encouraging fact from the study is that SWFs are already directing investment to climate sectors. This is not surprising, knowing that the United States, China, Japan, Saudi Arabia, UAE and others have devoted significant capital to MDBs and are proactively advocating for more climate investment. The study identifies seven actions related to sustainable investing that leading SWFs have implemented. I list them below to illustrate that MDBs have much to share with SWFs above and beyond cofinancing and direct investment opportunities. The corollary is that MDBs will have learnings to take from SWFs as well in their own work to act and capitalize on the collaboration committed to in Marrakech.

| SWF Implemented Actions | AIIB Application |

|---|---|

| 1. Incorporating low-carbon transition into strategic goals | - Energy Sector Strategy - Climate Action Plan |

| 2. Managing the carbon footprint of portfolios | - Environmental and Social Framework (ESF) - Assignment, monitoring and reporting of project indicators |

| 3. Participating actively in international processes and initiatives | - Alignment to ICMA Principles in AIIB’s Sustainable Development Bond Framework - Adoption of ISSB reporting standards (in progress) |

| 4. Accounting for ESG factors when screening and evaluating asset managers | - AIIB’s ESG-themed funds (externally managed) - AIIB’s ESG criteria for treasury liquidity assets (in progress) |

| 5. Exercising stewardship (active ownership) | - Portfolio management policies and procedures |

| 6. Using ESG integration and negative screening strategies | - ESF - Investment Committee and the Investment Project Cycle |

| 7. Making sustainability themed investments | - ESF - Sustainable Development Bond Framework |

The third action highlights a common challenge that can only be overcome through partnership. Market participants need data—information that will allow investment to be directed to where it has the most impact. Some impact-related information is available, but inconsistently. In partnering with MDBs, SWFs have a real chance to move sustainability reporting standards toward consensus by adding their substantial weight to the matter and by influencing from their position as a public entity.

AIIB is at the table in addressing the challenge. This year we will draft new reporting based on ISSB standards and move AIIB toward public disclosures for the 2025 reporting period. The standards are pragmatic in their current construct, and there will be room for future improvements inasmuch as stakeholders recognize capabilities will improve.

In general, AIIB’s own application of the seven actions from the CCICED study will result in more and better sustainable investing. On our path we look forward to stronger partnerships, more consensus on and adoption of standards and greater impact.

Where do you see the opportunities for SWFs and MDBs to work together? I welcome your opinion.