Developing and developed countries alike are in a tough spot due to COVID-19. Some economists predict a quick V-shaped recovery, while others expect an L-shaped one. Still others anticipate an uneven W-shaped recovery. There is nevertheless agreement that governments need to do whatever it takes to address the crisis, and that trillions of fiscal firepower is needed to weather and recover from the crisis, such as through stimulus packages worth an unprecedented USD9 trillion globally.1

Yet developing countries cannot borrow at the scale of developed countries. Early in the crisis, developing countries saw unprecedented capital outflows.2 Credit rating agencies have also downgraded the ratings of some developing countries due to a rise in borrowing costs.3 COVID-19 financing gaps, therefore, are expected to be immense for developing countries.

Covid Bonds—Up, Up, and Away

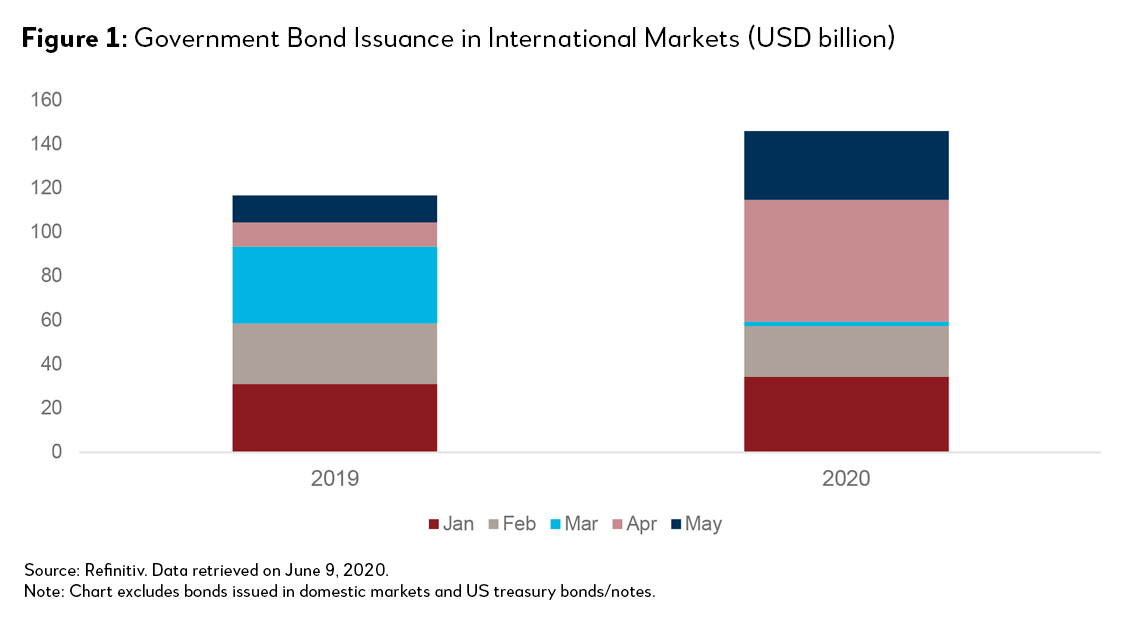

Against this backdrop, one approach increasingly used to fill developing countries’ financing requirements is to turn to international capital markets by issuing Covid bonds. In April 2020 alone, governments worldwide (excluding the US) issued USD55 billion in international bond markets.4 In fact, sovereign bond issuances from March to May surpassed issuances during the same time in the past year by over 50 percent (Figure 1). While we cannot say that all sovereign bond issuances since the onset of the COVID-19 crisis are pandemic-related, at least one quarter of sovereign bonds issued have news reports confirming the use of such proceeds for pandemic-related purposes.

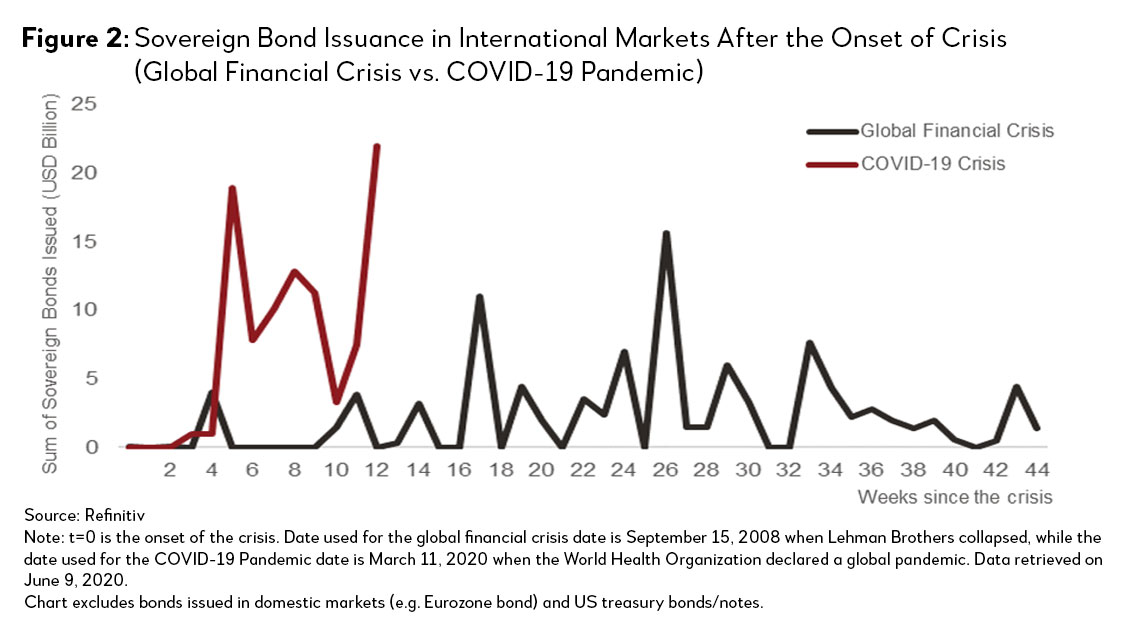

Compared with the global financial crisis in 2008/2009, countries responded faster this time around (Figure 2). During that period, we witnessed a surge in global sovereign bond issuance four months after the collapse of Lehman Brothers on Sept. 15, 2008. Furthermore, most bond issuances were by high-income and middle-income countries.5 In comparison, one month after the World Health Organization (WHO) declared COVID-19 a global pandemic (March 11, 2020), weekly sovereign bond issuances soared to nearly USD20 billion. Israel, for example, issued a total of USD5 billion sovereign bonds to fight COVID-19,6 19 days after the number of confirmed cases reached 100.7 The Philippines issued USD2.35 billion worth of Covid bonds 44 days after the number of confirmed cases reached 100.8 For Indonesia, it was 22 days.9

This good news is due, in part, to the liquidity boost from the efforts of the central banks (e.g., the US Federal Reserve, European Central Bank) of developed countries, which has helped to keep financial conditions stable and supported investors’ bond-buying spree.

News reports of these bond issuances indicate that proceeds will be used to create healthcare infrastructure, provide credit support to keep businesses running, ensure food security, reduce COVID-19 infections, develop testing capacity, alleviate supply chain disruptions, maintain basic services, and research new vaccines and related technologies.10

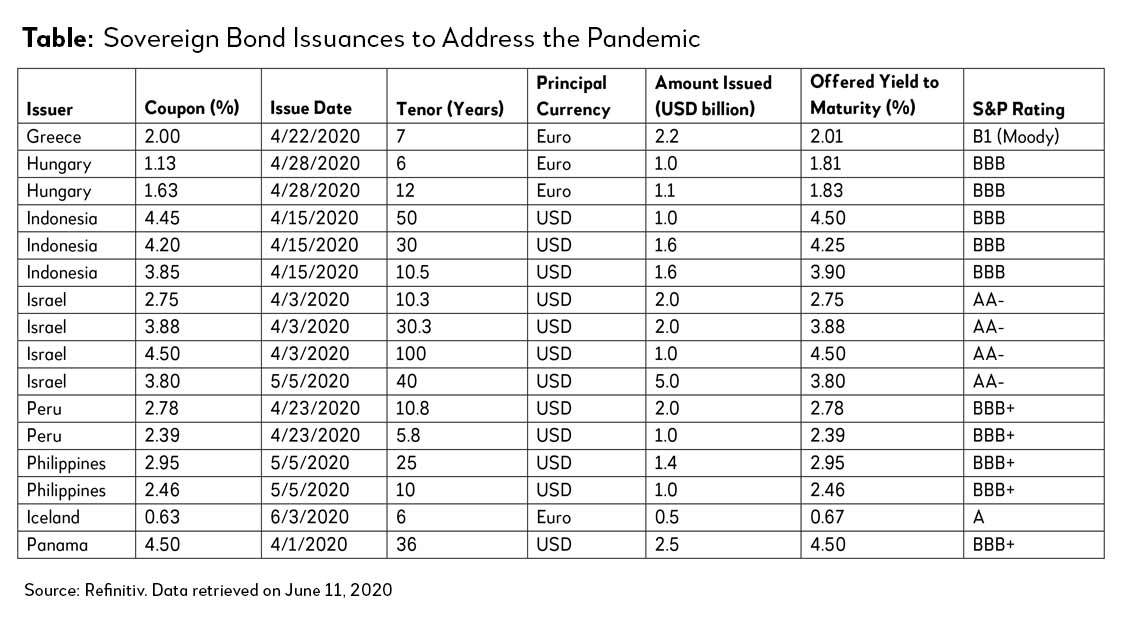

Over the past four months, 34 governments issued sovereign bonds in the international capital markets. Many of them have good fundamentals. Sixty percent of these were issued by high-income economies, while 40 percent were issued by middle-income economies. Eight (China, Bahrain, Indonesia, Israel, the Philippines, Qatar, Saudi Arabia, Türkiye) are regional Members of the Asian Infrastructure Investment Bank (AIIB). Many economies exhibit steady economic growth (pre-crisis), have effective governments, fiscal discipline, and were regular or occasional issuers prior to the crisis. Most have investment-grade ratings, although some recently experienced credit rating downgrades (while keeping their investment grade status), and a handful are non-investment grade. A snapshot of bond issuances for some of these countries, verified to be used for pandemic relief, is found below (Table).

Some countries are also testing the market with long tenors. Indonesia, for example, went to market with a 50-year USD1 billion bond—the first by the country and by Asia in history. Israel likewise issued its first 100-year USD1 billion bond. While longer maturity bond issuances are not unusual outside Asia even before COVID-19 (e.g., Mexico in 2015, Austria in 2017), such issuances suggest that countries are taking advantage of the low-interest rate environment and that there is a market appetite for long-dated bonds. Such bond issuances can also assist countries reduce rollover risks (although at higher yields) and extend the time horizon of their investments, making them suitable for investing in longer-term economic recovery needs, e.g., infrastructure.

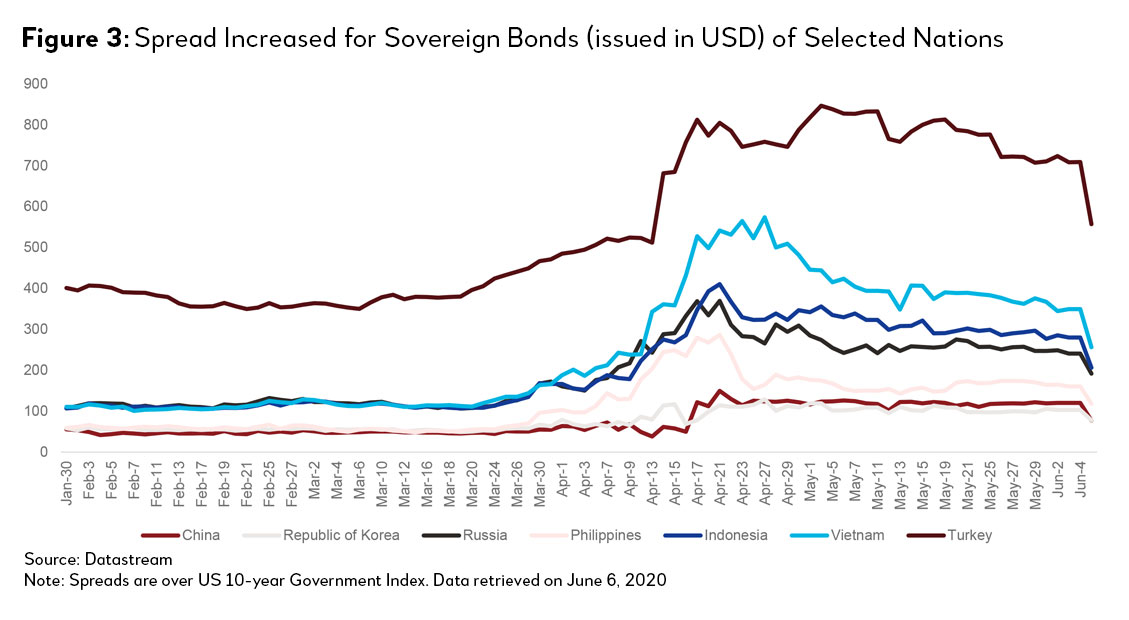

Despite near-zero global interest rates, yields of existing sovereign bonds among developing countries (e.g., Türkiye, Viet Nam, Russia) have increased. In recent weeks, spreads over US treasuries have started to decline but have yet to come down to their January levels (Figure 3).

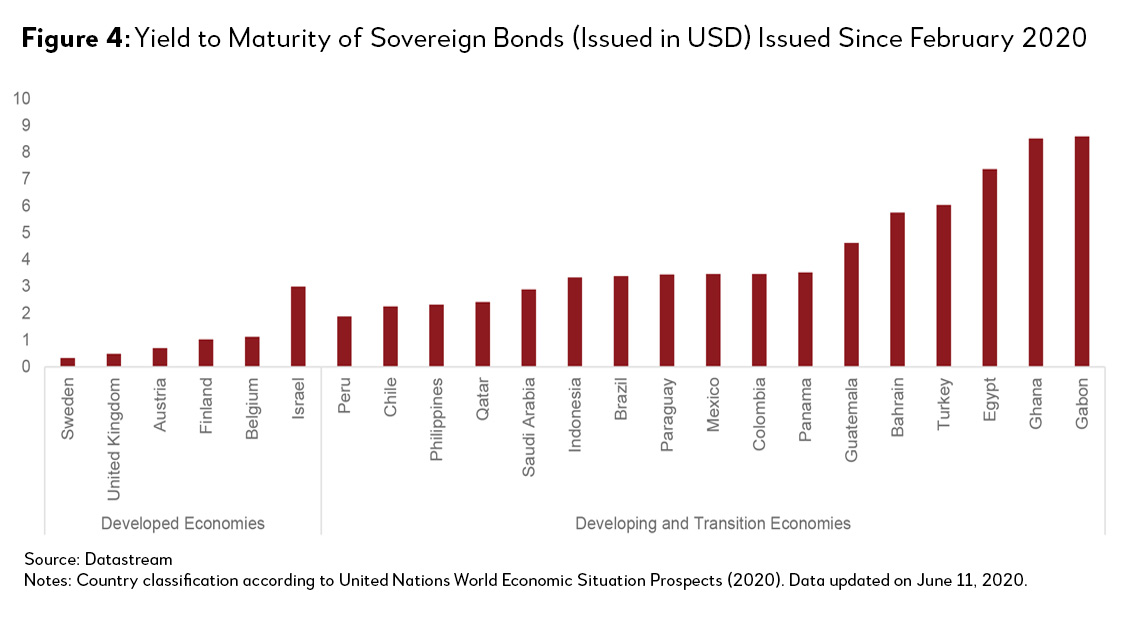

This suggests that while risks have abated somewhat, developing countries are perceived to be even riskier markets. Those with more favorable credit ratings (i.e., developed economies) are considered safe and their borrowing costs are significantly lower than their developing counterparts (Figure 4).

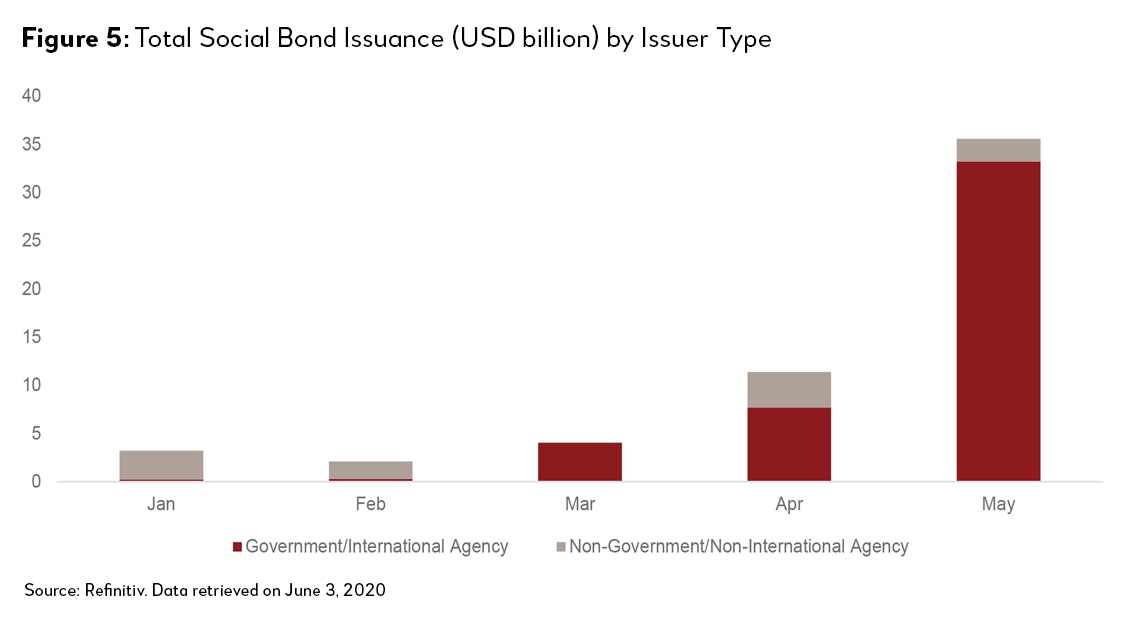

Given the objective of Covid bonds, such bonds can be broadly understood to be a type of social bond. Along these lines, the International Capital Market Association (ICMA) has extended their social bond categorization to include COVID-19 related use-of-proceeds.11 In fact, some sources attribute the increase in social bonds over the past few months to Covid bonds. For example, Financial Times indicated that USD65 billion Covid bonds were issued from February to April.12 This may indicate that nearly all social bonds issued since February, as seen in Figure 5, were due to COVID-19 related causes.13

While sovereign and international agencies dominate the social bonds sector (accounting for 85 percent of total issuances in 2020), more corporate issuers are entering the social bond market. Corporate social bond issuance is a good way to boost liquidity in the sector. In addition to relying on government support, firms (especially large ones) can help themselves by issuing bonds to maintain supply chains and pay their workforce, among others, during this pandemic. A major pharmaceutics producer, for example, issued a billion-dollar bond partly to support vulnerable patients’ access to medicines and vaccines.14 On the part of financial institutions, the Bank of China branch in Macao, China issued a COVID-19 related bond in February 2020.15 Bank of America likewise issued the first pandemic bond among US financial institutions this May.16

Maintaining Market Access Through Fundamentals

COVID-19 is posing the most significant economic dislocation since the Great Depression. The fact that market access remains possible for many developing economies is a vote of confidence in the macroeconomic policies and management of these economies. The wave of COVID-19 financing remains critical for medium- to long-term economic recovery, such as supporting infrastructure investments and stimulating productive sectors. The lesson perhaps for developing countries is to strengthen one’s fundamentals (e.g., effective institutions, macroeconomic stability) and avenues for financing (e.g., strong domestic capital markets) while the sun is up so they have ability to borrow when a storm hits.

1 B. Battersby, W. Raphael Lam and E. Ture. 2020. Tracking the $9 Trillion Global Fiscal Support to Fight COVID-19. IMFblog. International Monetary Fund (IMF). (May 20). https://blogs.imf.org/2020/05/20/tracking- the-9-trillion-global-fiscal-support-to-fight-covid-19/

2 K. Georgieva. 2020. Confronting the Crisis: Priorities for the Global Economy. Speech by the IMF Managing Director. IMF. (April 9) https://www.imf.org/en/News/Articles/2020/04/07/sp040920- SMs2020-Curtain-Raiser

3 Fitch Ratings. 2020 What Investors Want to Know: Emerging-Market Sovereigns—2Q20. (April 20). https://www.fitchratings.com/research/sovereigns/what-investors-want-to-know-emerging-market-sovereigns-2q20-21-04-2020

4 Excluding US treasury bonds/notes and bonds issued in domestic markets.

5 Data from Refinitiv.

6 S. Scheer. 2020. Update 1-Israel Sells Rare “Century Bonds” in Record $5 Bln Debt Issue. Reuters. (April 1). https://www.reuters.com/article/israel-bonds/update-1-israel-sells-rare-century-bonds-in-record-5-bln-debt-issue-idUSL8N2BP1AU.

7 COVID-19 confirmed case data is from the Center for Systems Science and Engineering, Johns Hopkins University.

8 C. Santiago. 2020. RoP Returns to Bond Market to Help Fund COVID-19 Mitigation Measures. The Asset. (April 29). https://www.theasset.com/capital-markets/40302/rop-returns-to-bond-market-to-help-fund-covid-19-mitigation-measures

9 Reuters. 2020. Indonesia Raises $4.3 Billion in the First “Pandemic Bond”. (April 7). https://www.cnbc.com/2020/04/07/indonesia-raises-4point3-billion-in-the-first-pandemic-bond.html.

10See, for example, footnotes 6, 8 and 9.

11 See International Capital Market Association definition: https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Social-Bonds-Covid-QA310320.pdf.

12 Financial Times. 2020. Fund Managers Pile into $65bn COVID-19 Bond Market. https://www.ft.com/content/03dbe400-1bea-4475-bda7-2fbc1d9ce062.

13 Institutes differ in their estimation of the size of COVID-19 focused bonds as there are no rules on what constitutes a “coronavirus” bond. BNP Paribas estimated the total COVID-19 bonds size is USD151 billion by the end of May. See A. Hirtenstein. 2020. Investors Channel Over $150 Billion Into Coronavirus Bonds. Wall Street Journal (June 3). https://www.wsj.com/articles/investors-channel-over-150-billion-into-coronavirus-bonds-11591178004.

14 Pfizer. 2020. Pfizer Completes $1.25 Billion Sustainability Bond for Social And Environmental Impact. Press Release. (March 27). https://www.pfizer.com.sg/pfizer-completes-125-billion-sustainability-bond-social-and-environmental-impact.

15 Allen and Overy. 2020. Bank of China [Macao, China Branch] First Chinese Issuer to Issue Social Bonds in the Offshore Market. Press Release. (March 9) https://www.allenovery.com/en-gb/global/news-and-insights/news/bank-of-china-macau-branch-first-chinese-issuer-to-issue-social-bonds-in-the-offshore-market.

16 D. Caleb Mutua. 2020. Bank of America’s $1 Billion Virus Bond Breaks New Ground for U.S. Banks. Bloomberg (May 15) https://www.bloomberg.com/news/articles/2020-05-14/bofa-s-1-billion-virus-bond-breaks-new-ground-for-u-s-banks.