“Climate Change increasingly poses one of the biggest long-term threats to investments.”

Christiana Figueres

Executive Secretary, United Nations Framework

Convention on Climate Change (UNFCCC)

UN Investor Summit on Climate Risk, 2014

In the face of growing global mobilization to fight climate change, policy makers and regulators have started to take action. The Paris Agreement (2015) stands as the collective global goalpost and calls for the limiting of global temperature increase to “well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels”. Building on this, groups of leading institutional investors responded positively by integrating climate change into their investment processes.

Two broad investment approaches exist: reduction and addition. The reduction approach involves decreasing exposure to investments with high transition risk. For example, the Portfolio Decarbonization Coalition, consisting of 32 investors and with over USD800 billion of assets under management, aims to reduce their exposure to greenhouse gas emissions.1

The addition approach involves increasing exposure to sustainable investment instruments which direct financial flows towards low carbon and climate resilient initiatives. Green bonds are a good example of the second approach. Green bonds have both a high degree of transparency over the intended use of proceeds as well as an independent opinion mechanism. Both characteristics provide enough high quality information for institutional investors to analyze and have belief that their investment contributes to climate goals. However, not all issuers that are actively working towards achieving Paris Agreement goals would necessarily issue green bonds (and vice versa). In addition, the transparency of green bonds is limited to a narrow and specific part of the overall issuer’s balance sheet.

Therefore, despite there being encouraging steps towards addressing climate change in the capital markets, a holistic approach that considers climate-aligned bonds at the market and institutional levels is lacking. At the market level, there is a lack of appropriate standardization on the definition of climate-aligned securities across asset classes. These include corporate bonds or listed equity from issuers who are making sustained, positive progress towards achieving Paris Agreement goals. At the institutional level, most initiatives, such as the Climate Action 100+, focus on selecting issuers that work toward addressing individual objectives of the Paris Agreement, instead of selecting issuers that do this for all three objectives: (i) climate change mitigation, (ii) climate change adaptation, and (iii) alignment of financial flows toward low greenhouse gas emissions and climate-resilient development solutions.

The Role of Institutional Investors in Picking “Climate Champions”

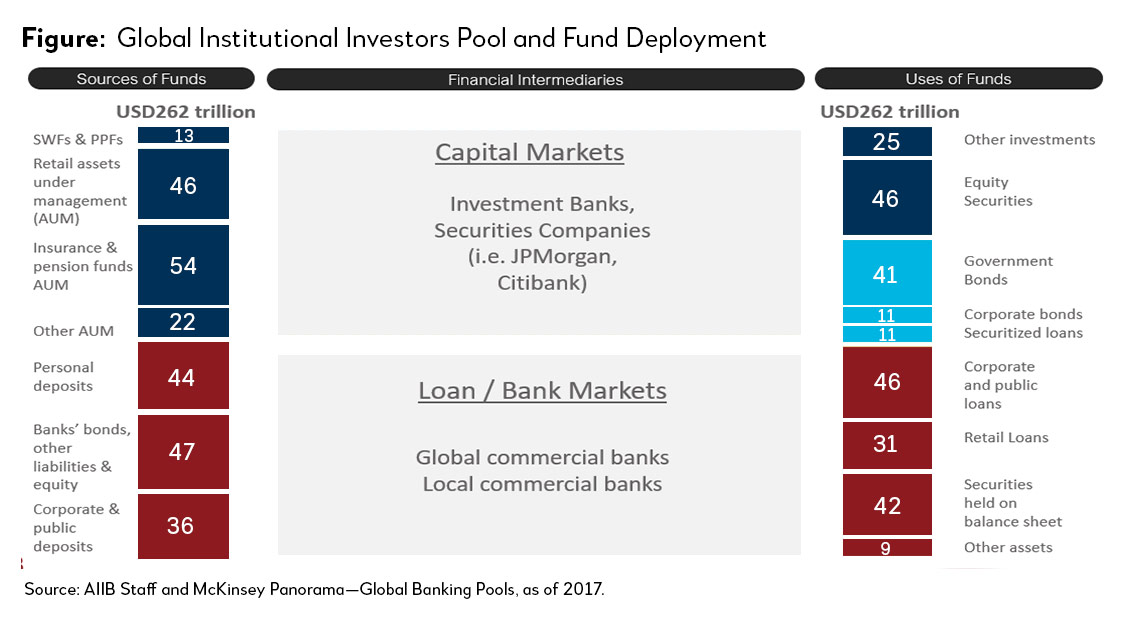

Mobilizing capital from institutional investors is key when considering how to “move the needle” in channeling finance to deserving issuers (i.e. Climate Champions) that are on the path towards achieving Paris alignment. Institutional investors are major players that have the potential to shape investment decisions in the capital markets due to control in the deployment of significant amounts of assets under management (AUM) (Figure).

Besides the positive impact of closing the climate finance gap, investing in Climate Champions would also protect portfolio returns, especially when enacted before the impacts of climate change are priced in by the capital markets. Already, signs are pointing towards climate-conscious investing becoming an enduring trend, such as:

- growth in the number of investors committing to decarbonize their portfolio,2

- year-on-year growth in the issuance of green bonds,3

- increasing ease of obtaining data on climate risk and impact for materiality assessment,4 and

- inflow of an additional USD15 to 20 trillion in capital from a new generation of climate-conscious retail investors.5

Selecting the Right Climate Champions

Given the importance of climate-conscious investing, it is important to for institutional investors to pick Climate Champions that are not only resilient to, but are also well positioned to realize opportunities brought about by the impacts of climate change. These Climate Champions are issuers that perform well on all three objectives of the Paris Agreement.

The Asian Infrastructure Investment Bank (AIIB), along with Amundi, aims to launch a Climate Change Investment Framework that would guide investors to do just that. This Framework, which has been endorsed by the Climate Bond Initiative (CBI), will be operationalized through AIIB’s USD500 million Asia Climate Bond Portfolio.6 The portfolio will accelerate climate action in the Bank’s members and address the underdevelopment of the climate-aligned bond market in accordance with the Framework.

The Framework, which is targeting a Fall-2020 launch, will function as a practical guide that will help investors select data-driven inputs for the evaluation of issuer-level performance in meeting the three objectives of the Paris Agreement. It will also set thresholds for the selection of Climate Champions, considering an investor’s portfolio geography and sector exposure requirements. Establishing meaningful thresholds will help investors pinpoint variables in which an issuer is relatively weaker. Tailoring an engagement strategy around these targeted issues would then offer greater help in pushing “transitioning” companies to become full-fledged Climate Champions.

As the Framework provides a systematic way of holistically assessing Climate Champions, AIIB envisions that it will be applicable to institutional investors worldwide. The Framework will also be especially relevant to investors that are interested in increasing exposure to Climate Champions in emerging markets, as it will feature a case study application to AIIB’s Asia Climate Bond Portfolio.

1 The Portfolio Decarbonization Coalition. https://unepfi.org/pdc/.

2 The Portfolio Decarbonization Coalition. 2015. Portfolio Decarbonization Coalition now overseeing decarbonization of $600bn Assets Under Management.

3 Climate Bond Initiative (CBI). 2019 Green Bond Market Summary.

4 With better data and transparency, information on a corporate’s climate mitigation, adaptation and transition efforts are systematically being integrated by capital market focused ESG data providers and rating agencies.

5 MSCI’s Introducing ESG Investing Report (2018) forecasts that over the next two decades, millennial generation could put between USD15 trillion and USD20 trillion into U.S.-domiciled investments that are targeted towards alleviating environmental and social problems. This would very likely include low-carbon and climate-resilient investments.

6 More information about the Asia Climate Bond Portfolio can be found at https://www.aiib.org/en/projects/details/2019/approved/Multicountry-Asia-Climate-Bond-Portfolio.html.