The annual meetings of the Asian Infrastructure Investment Bank (AIIB) present a unique opportunity for us to meet face-to-face and engage with many of our key stakeholders. It is an intense couple of days—but intense in a good way. We get to dig very deeply into the opportunities and issues that matter most to the people who work with us, invest with us and are impacted by our projects.

This was my third annual meeting with the Bank and I am always amazed by the diversity of voices in attendance. Their collective wisdom and experience are rich resources and I know many of my colleagues tried to spend as much time as possible with as many people as possible over the two-day meeting.

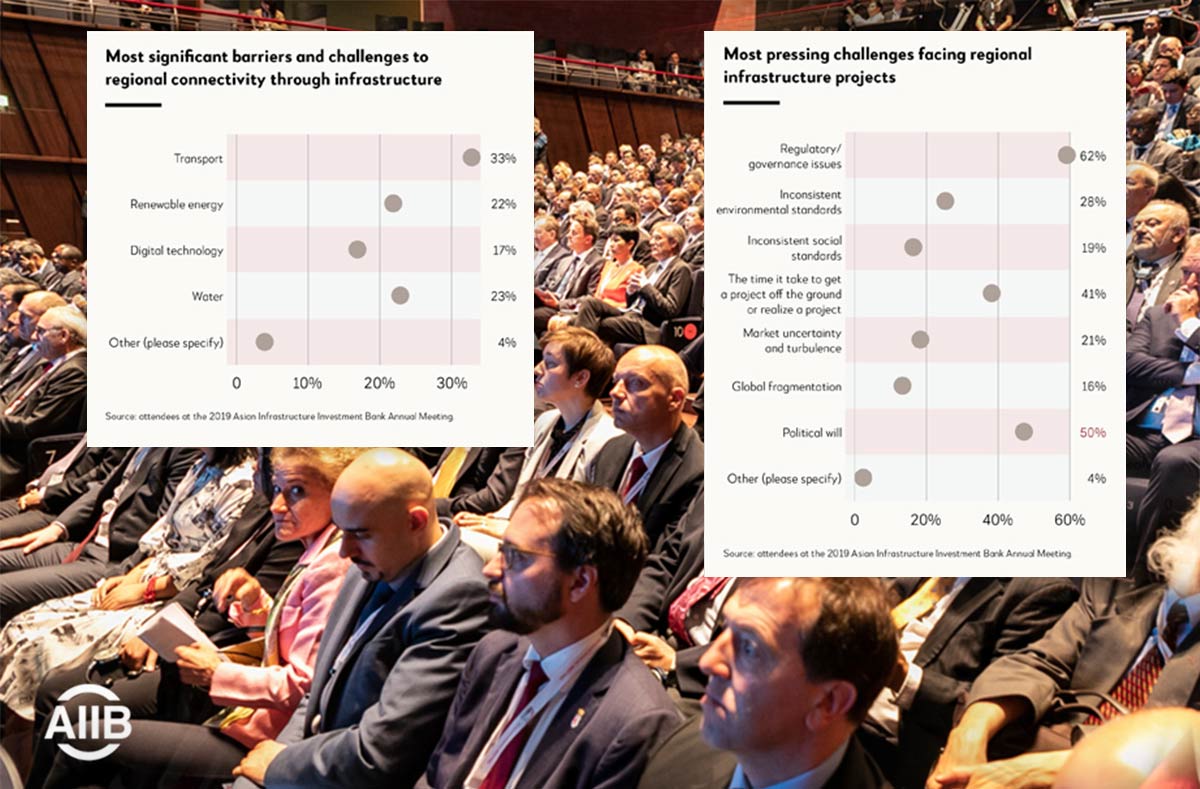

This year, we did something new to holistically tap into this well of knowledge. We introduced a delegate survey which asked questions about infrastructure issues and trends that affect us all. Over 100 delegates responded and we’ve captured some of the more interesting insights below.

According to 2019 AIIB Annual Meeting delegates in Luxembourg, the biggest challenge facing regional infrastructure projects is the existence of regulatory and governance issues (62 percent). This was followed not too far behind by political will (50 percent). Couple these insights with the transport sector being identified as the sector with the most significant barriers and challenges to regional connectivity and we can see a clear narrative beginning to appear.

Transport projects rely very heavily on soft infrastructure to maximize their impact and return on investment. If regulatory and policy frameworks are not aligned along the route of a transport project, people and goods are not able to pass through immigration and customs borders with ease. This adds delays and costs, and negatively impacts the access to markets which transport projects can unlock.

In AIIB’s Transport Sector Strategy we identified the need for policy coordination between countries as an important aspect of successful cross-border connectivity projects. In his opening address at the 2019 AIIB Annual Meeting, AIIB President Jin Liqun also acknowledged this roadblock. He said one of the solutions to removing these impediments lies within the delegates themselves. He called on delegates to “work together,” “remove these roadblocks” and “create domestic reforms, perform policy coordination and think holistically about country and regional infrastructure and supporting facilities.”

Essentially, the issues most prominently raised by annual meeting delegates are also acutely felt by AIIB. The path forward has been laid out. It’s now time for the annual meeting theme of “Cooperation and Connectivity” to be taken to heart. As President Jin said: “by working together, we have the power to remove these roadblocks.”

Beijing, February 13, 2026

Enhancing Women’s Access to Public Services and Economic Opportunities through Rural Infrastructure in Cambodia

How AIIB financed rural road improvements in Cambodia are enhancing women’s access to healthcare, education, markets and livelihoods through gender responsive infrastructure and community driven planning.

READ MOREBeijing, February 12, 2026

Blending Policy and Performance: From CPBF to Downstream Investments

How AIIB strategically sequences and blends CPBF, RBF and IPF to turn policy reforms into bankable projects, mobilize private capital, and deliver measurable climate and development outcomes.

READ MOREBeijing, January 23, 2026

Strategic Portfolio Management Can Transform Development Finance. AIIB is Setting the Tone

The success of development finance lies not just in the projects approved but also in how they are delivered. As infrastructure needs grow and development challenges become more complex, multilateral development banks (MDBs) face not just an institutional mandate but a moral one – to ensure that projects deliver tangible impact to the millions they serve.

READ MOREBeijing, January 14, 2026

Supporting AIIB’s Mission through Sustainable and Effective Services

As AIIB enters 2026 and our second decade of operations, delivering sustainable infrastructure across regions depends not only on financing and partnerships, but also on the systems, services and spaces that support the Bank’s core business every day. The Facilities and Administration Services Department (FAS) plays a central and continuous role in enabling AIIB’s operational resilience, institutional maturity and people-first workplace culture.

READ MORE