The Asian Infrastructure Investment Bank (AIIB) and the Nordic Investment Bank (NIB) signed a memorandum of understanding to establish areas of collaboration to advance sustainable infrastructure and green development.

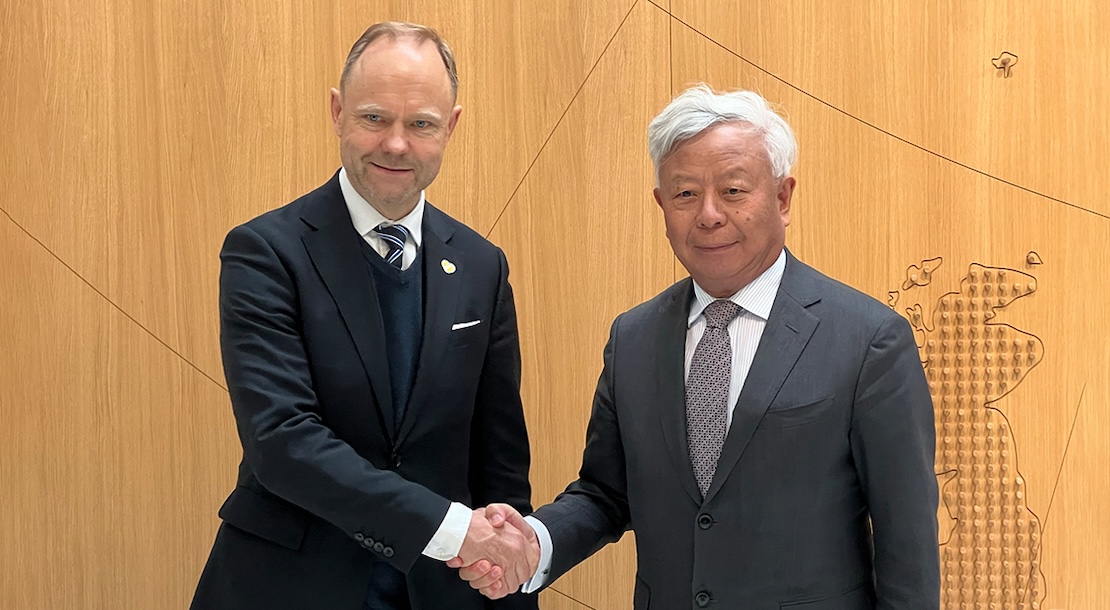

The MOU was signed by President Jin Liqun of AIIB and President and CEO André Küüsvek of NIB in the presence of representatives from both organizations.

“Formalizing this partnership with Nordic Investment Bank marks an important step forward,” Jin said. “It underscores our shared vision of advancing sustainable development and addressing global challenges through collective efforts. Together, we can broaden access to sustainable infrastructure financing, drive inclusive growth and accelerate the transition to a low-carbon future.”

Küüsvek added: "This MOU formalizes our willingness to work together, ensuring long-term institutional engagement. NIB's core mission is to finance projects that improve productivity and benefit the environment in our region. However, we have always operated beyond our region as well, and this cooperation with AIIB exemplifies our commitment to international collaboration. We share the common goal of financing infrastructure development and aim to foster sustainable and inclusive economic growth."

The MOU covers areas of cooperation between the two institutions, including joint identification and sharing of investment opportunities and cooperation in human resources, corporate governance and internal policies, information technology, and legal services. It also enables the exchange of knowledge, expertise, best practices, and research in sectors such as clean technology and climate change.

By aligning their respective strengths and experiences, AIIB and NIB aim to enhance the quality and impact of sustainable infrastructure financing. The MOU reflects a shared commitment to foster long-term, inclusive and environmentally responsible growth.

About AIIB

The Asian Infrastructure Investment Bank is a multilateral development bank dedicated to financing “infrastructure for tomorrow,” with sustainability at its core. AIIB began operations in 2016, now has 110 approved members worldwide, is capitalized at USD100 billion and is AAA-rated by major international credit rating agencies. AIIB collaborates with partners to mobilize capital and invest in infrastructure and other productive sectors that foster sustainable economic development and enhance regional connectivity.

About NIB

NIB is an international financial institution owned by eight member countries: Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway, and Sweden. The Bank finances private and public projects in and outside the member countries. NIB has the highest possible credit rating, AAA/Aaa, with the leading rating agencies S&P Global Ratings and Moody’s.