The Asian Infrastructure Investment Bank (AIIB) and the National Bank for Financing Infrastructure and Development (NaBFID) signed a letter of intent to foster joint efforts to develop sustainable infrastructure in India, with a strong emphasis on climate adaptation and mitigation. The agreement marks a strategic step toward accelerating sustainable infrastructure development in India.

AIIB and NaBFID will jointly identify and develop high-impact climate financing projects across key sectors such as renewable energy, energy storage, and clean transportation, using both innovative and conventional financing solutions. This partnership supports India’s goal of becoming a USD5-trillion economy and aligns with its nationally determined contributions, promoting low-carbon and climate-resilient growth. It also aligns with AIIB’s thematic priority on Green Infrastructure.

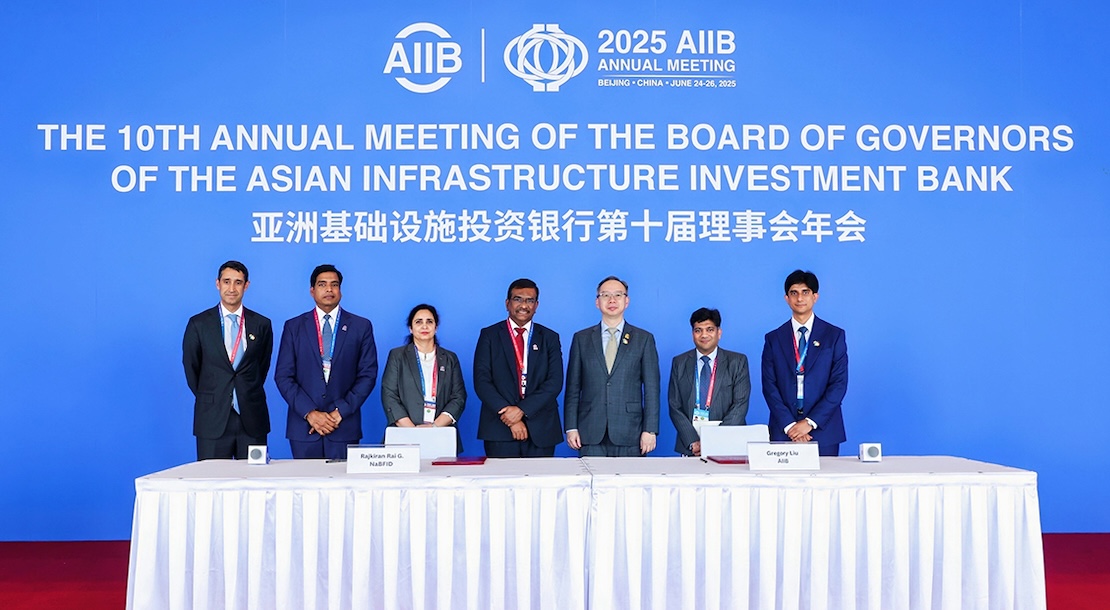

“We are thrilled to embark on this partnership with National Bank for Financing Infrastructure and Development, recognizing the significant overlaps in our institutional mandates, particularly in climate and sustainable infrastructure financing,” said Gregory Liu, Director General of AIIB’s Financial Institutions and Funds Global Department. “This collaboration presents a powerful opportunity to accelerate the delivery of transformative infrastructure across India’s critical sectors, driving economic growth while reinforcing the government’s national climate action agenda. We look forward to building on this momentum and elevating our joint efforts to even greater heights.”

“This collaboration marks a pivotal step in our journey as an enabler of sustainable infrastructure in India,” said Rajkiran Rai G, Managing Director of NaBFID. “By channelling investment into climate-resilient infrastructure, we are setting the stage for a more inclusive, sustainable and self-reliant economy. As we move steadily towards the long-term development goals, we are proud to play a role of a catalyst in the Indian infrastructure sector.”

The collaboration will prioritize sustainability and climate resilience throughout project selection and implementation. It also aims to facilitate joint infrastructure investments by applying funded and non-funded instruments, including guarantees, while enabling the exchange of technical expertise between the two institutions.

The partnership will also include capacity-building initiatives, including joint seminars, workshops, and research programs that will help strengthen institutional capabilities in infrastructure planning and execution.

Rai G and Liu signed the letter of agreement at the 10th Annual Meeting of AIIB in the presence of key officials of NaBFID including Monika Kalia, Deputy Managing Director, and Samuel Joseph Jebaraj, Deputy Managing Director. It lays the foundation for thematic-level collaboration between AIIB and NaBFID, enabling both to contribute to India’s infrastructure transformation within their respective mandates.

About AIIB

The Asian Infrastructure Investment Bank is a multilateral development bank dedicated to financing Infrastructure for Tomorrow, with sustainability at its core. AIIB began operations in 2016, now has 110 full and approved members worldwide, is capitalized at USD100 billion, and is AAA-rated by major international credit rating agencies. AIIB collaborates with partners to mobilize capital and invest in infrastructure and other productive sectors that foster sustainable economic development and enhance regional connectivity.

About National Bank for Financing Infrastructure and Development

The National Bank for Financing Infrastructure and Development is a development financial institution established in April 2021. The institution is dedicated to accelerating the development of India’s infrastructure ecosystem by addressing the long-term financing needs of the sector. The institution plays a pivotal role in driving the nation’s economic growth and fostering sustainable development. It is committed towards its vision of becoming a strong provider of impact investment, catalysing infrastructure financing for transformative growth of India.

The institution aims to be a key partner in helping India achieve its ambitious infrastructure development objectives, responsibly and sustainably. Additionally, the institution will work towards developing a deep and liquid market for bonds, loans, and derivatives for infrastructure financing.