The Asian Infrastructure Investment Bank (AIIB) launched its inaugural health strategy in December 2024, marking its first comprehensive strategy in social infrastructure and the first health-focused strategy by a multilateral development bank since the COVID-19 pandemic.

The strategy draws on AIIB’s experience financing health projects – 22 projects to date with USD4.87 billion in approved financing – and outlines the direction in which the Bank can develop a niche and create value. It provides a roadmap to address health challenges across members and underscores AIIB’s commitment to social development and inclusion by enabling it to contribute to improved health outcomes in Asia and beyond.

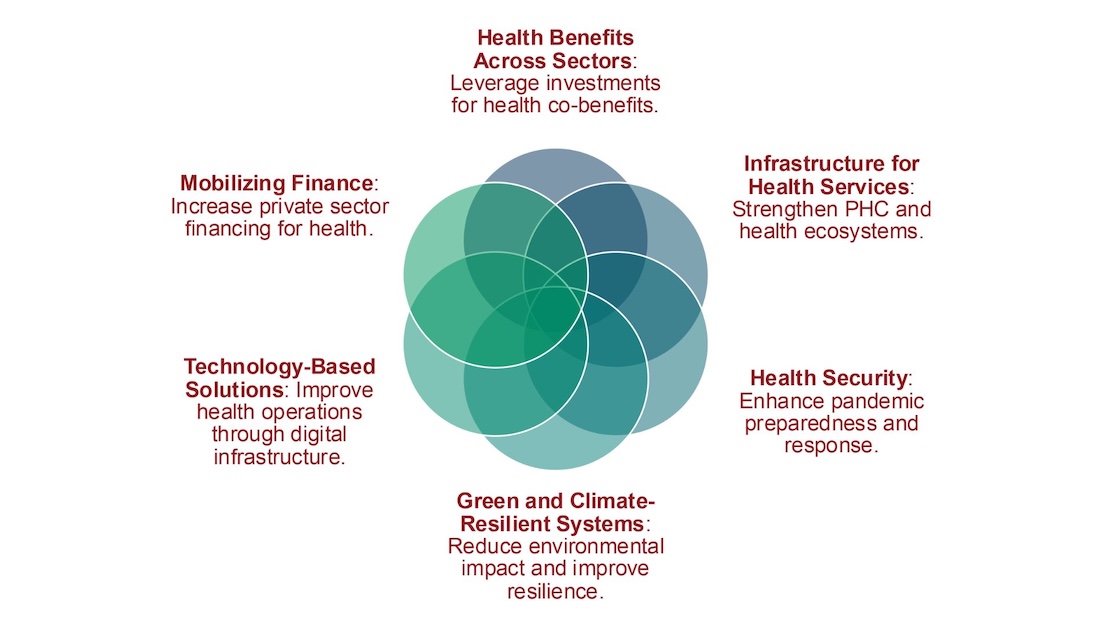

The global pandemic revealed fragilities and inequalities in health systems, emphasizing the need for greater investments in health system resilience and global health security. AIIB’s health strategy provides a framework for financing solutions that strengthen health systems and deliver sustainable outcomes. It links health, infrastructure and economic development, emphasizing the role of infrastructure in underpinning healthy living. The strategy is guided by five principles and outlines

six strategic priorities.

AIIB will implement the strategy gradually, leveraging partnerships with multilateral banks, health organizations and private sector actors. A robust monitoring framework will track progress and ensure alignment with strategic priorities, solidifying AIIB’s role in advancing health infrastructure for sustainable development.

About AIIB

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank whose mission is Financing Infrastructure for Tomorrow in Asia and beyond—infrastructure with sustainability at its core. We began operations in Beijing in 2016 and have since grown to 110 approved members worldwide. We are capitalized at USD100 billion and AAA-rated by the major international credit rating agencies. Collaborating with partners, AIIB meets clients’ needs by unlocking new capital and investing in infrastructure that is green, technology-enabled and promotes regional connectivity.