There is a large body of work that points to the beneficial effects of international trade. However, we continue to observe tariff barriers, especially in developing economies. From the literature, there is also some evidence that trade liberalization in developing economies can sometimes lead to bigger trade deficits. Many developing economies are also slow to liberalize trade. In our paper “Infrastructure Quality and Trade Liberalization”, we provide some evidence that poor infrastructure could be the root cause that hampers trade liberalization.

Our thinking is as follows. When tariffs are high, there would be little trade, and poor infrastructure would not matter that much. However, when tariffs are reduced, countries with poorer infrastructure begin to face an exporting disadvantage against countries with better infrastructure, and that would begin to show up more readily as negative trade balances. We worked with an extension of the trade gravity model, embedded infrastructure quality into it, and tested its prediction using trade data. We find evidence that indeed, countries with poorer infrastructure see larger bilateral trade deficits against those with better infrastructure, post liberalization.

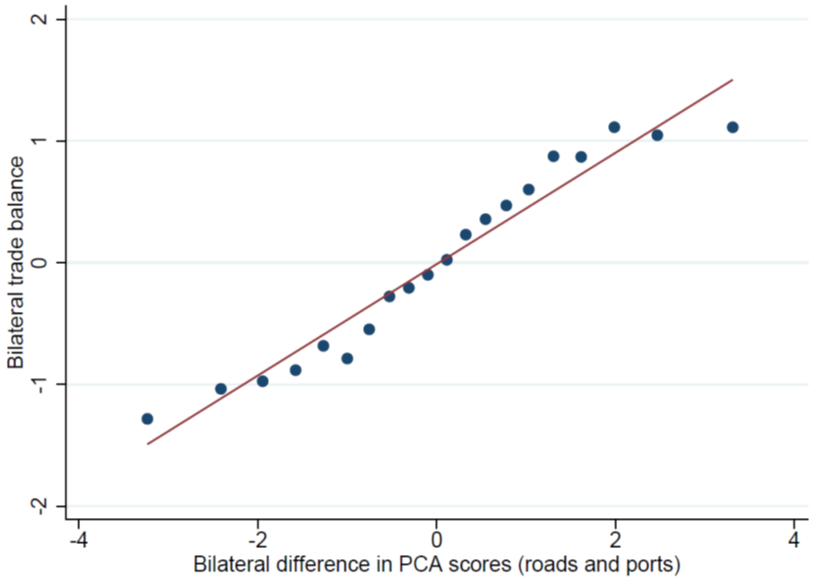

The chart below summarizes the study. The X-axis records the infrastructure score differences (using principal component of roads and ports) between bilateral trade partners, while the Y-axis records the bilateral trade balance. The positive correlation shows that those economies with a positive gap against trade partners tend to have a trade surplus, while those economies with a negative infrastructure gap against trade partners tend to have a trade deficit. Over large samples involving many bilateral pairs, the pattern holds, as summarized in the bin scatter plot. Our regressions confirm this relationship, and that the bilateral trade imbalances become wider post liberalization.

The key conclusion we bring is that poor infrastructure can hurt trade outcomes, especially post liberalization. This may explain why developing economies are reluctant to liberalize. The key message we bring is that infrastructure development needs to complement trade liberalization, in order for developing economies to benefit more fully from trade.

The full working paper Infrastructure Quality and Trade Liberalization is available under AIIB Working Papers on the Bank’s website.