The Asian Infrastructure Investment Bank (AIIB) created a COVID-19 Crisis Recovery Facility (CRF or the Facility) to support AIIB’s Members and clients in alleviating and mitigating economic, financial and public health pressures arising from COVID-19.

The Facility had an initial duration of 18 months and a size of USD5 billion. Due to high client demand, the Facility was subsequently expanded and extended to USD13 billion until April 2022. Once this full amount had been committed, approved or programmed, the Facility was further expanded to a total financing of USD20 billion and its duration extended until Dec. 31, 2023.

The Facility was available to both public and private sector entities in any AIIB Member that was facing (or at risk of facing) serious adverse impacts as a result of COVID-19.

The Facility was designed to be flexible and adaptive to the diverse emergency health care and economic needs of AIIB Members.

For projects that entered the Facility pipeline prior to or on February 24, 2022, AIIB financing considered financing immediate health sector needs (including vaccines) and supporting measures that address economic resilience and liquidity constraints.

For projects that entered the Facility pipeline after February 24, 2022, AIIB financing covered a narrower scope of eligible pandemic-related responses:

- cofinancing the procurement, distribution and deployment of COVID-19 vaccines and therapeutics;

- cofinancing Policy-Based Financing for enhanced pandemic response, preparedness, and recovery; and

- financing essential COVID-19 emergency health care or urgent expenditure needs.

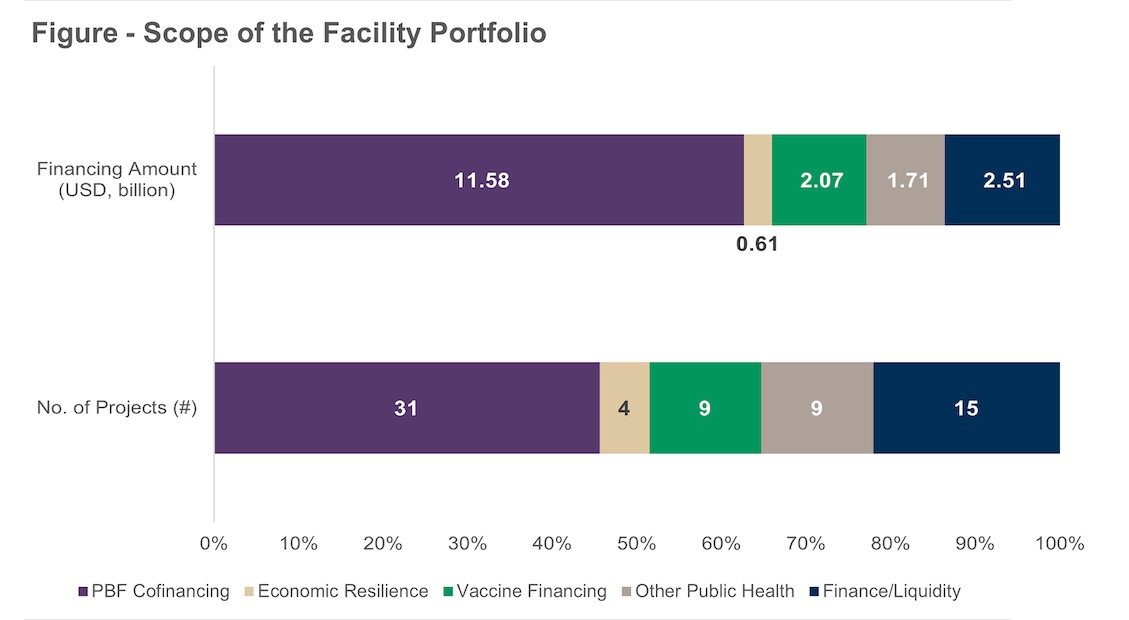

As of December 2023, 68 Facility projects had been approved, totaling USD18.48 billion across 26 Members including: USD11.58 billion (63%) policy-based financing, USD3.78 billion (20%) public health, of which USD2.07 are vaccine financings; USD2.51 billion (14%) for financial intermediary/liquidity support; USD0.61 billion (3%) for economic resilience.