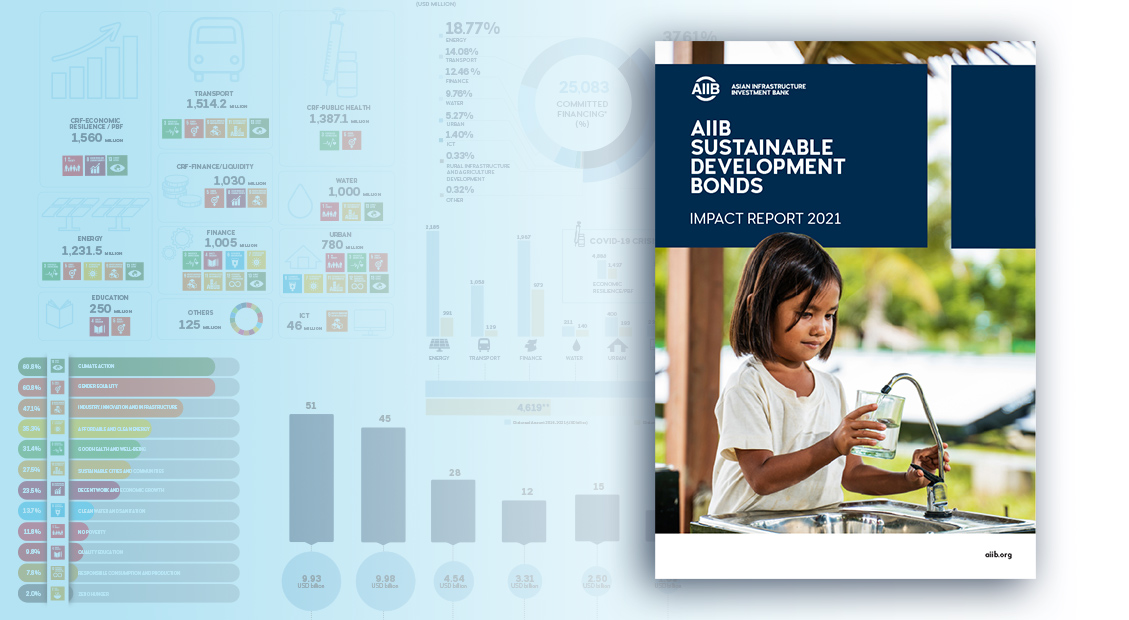

The Asian Infrastructure Investment Bank (AIIB) has launched its second Sustainable Development Bonds Impact Report, which illustrates how the proceeds from AIIB’s bonds are used to realize AIIB’s mission to finance Infrastructure for Tomorrow. The Report offers investors a view of the sustainable nature and impact of AIIB’s financings.

This second edition of the Impact Report shares insights on the Bank’s financing in key infrastructure sectors—including sustainable energy, transportation, water, digital infrastructure—and AIIB’s COVID-19 Crisis Recovery Facility (CRF) to show the environmental and social benefits of such projects. In addition, the Report highlights how AIIB is supporting its Members achieve the UN Sustainable Development Goals (SDGs) as well as their goals under the Paris Agreement on Climate Change.

In particular, this year’s Impact Report reflects AIIB’s distinct focus on green infrastructure. In 2021, AIIB’s climate finance has totalled 48% of approved financing (excluding those under the CRF), up from 41% in the previous year, indicating progress toward the 50% by 2025 target set in AIIB’s Corporate Strategy. As of 2021, after only six years of operations, AIIB has directly financed 4,502 MW renewable energy capacity; financed 32,494 km of roads, which include climate resilience measures; and helped save 26,334 GWh of primary energy through its investments to improve energy efficiency. AIIB’s total investments into the energy sector are expected to avoid 16.3 million tons of carbon dioxide equivalent (CO2e) of GHG emissions per year, thus contributing to the Paris Agreement climate ambitions. The Report is issued pursuant to AIIB’s Sustainable Development Bond Framework, and AIIB’s undertaking to deliver annual impact reporting on its overall portfolio- and project-level results to track AIIB’s commitment to sustainable development.

“As sustainable investing is increasingly embraced by investors, the Impact Report is an opportunity for AIIB to communicate the sustainable nature of our strategy, efforts and accomplishments,” said AIIB Treasurer Domenico Nardelli, “Complementing the revisions to our Environmental and Social Framework (ESF) in 2021, this report demonstrates AIIB’s continued commitment to its mandate of financing Infrastructure for Tomorrow, as well as to communicating the sustainable nature of our business.”

AIIB launched its inaugural Sustainable Development Bonds Impact Report (2020) last year. Each Impact Report presents data on AIIB’s portfolio volume and alignment with thematic priorities and portfolio performance, as well as project impact stories. Compared to the case study-based project-level reporting last year, this year’s Report includes illustrative sector-level environmental and social impact indicators. AIIB’s Sustainable Development Bond Framework and Impact Report approach will be reviewed over time to reflect the evolution of the green, social and sustainable bond markets and changes in AIIB’s strategies, policies and processes, as the Bank’s portfolio matures.

The full 2021 Impact Report can be downloaded from the AIIB website.

About AIIB

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank whose mission is financing the Infrastructure for Tomorrow—infrastructure with sustainability at its core. We began operations in Beijing in January 2016 and have since grown to 105 approved members worldwide. We are capitalized at USD100 billion and Triple-A-rated by the major international credit rating agencies. Collaborating with partners, AIIB meets clients’ needs by unlocking new capital and investing in infrastructure that is green, technology-enabled and promotes regional connectivity.