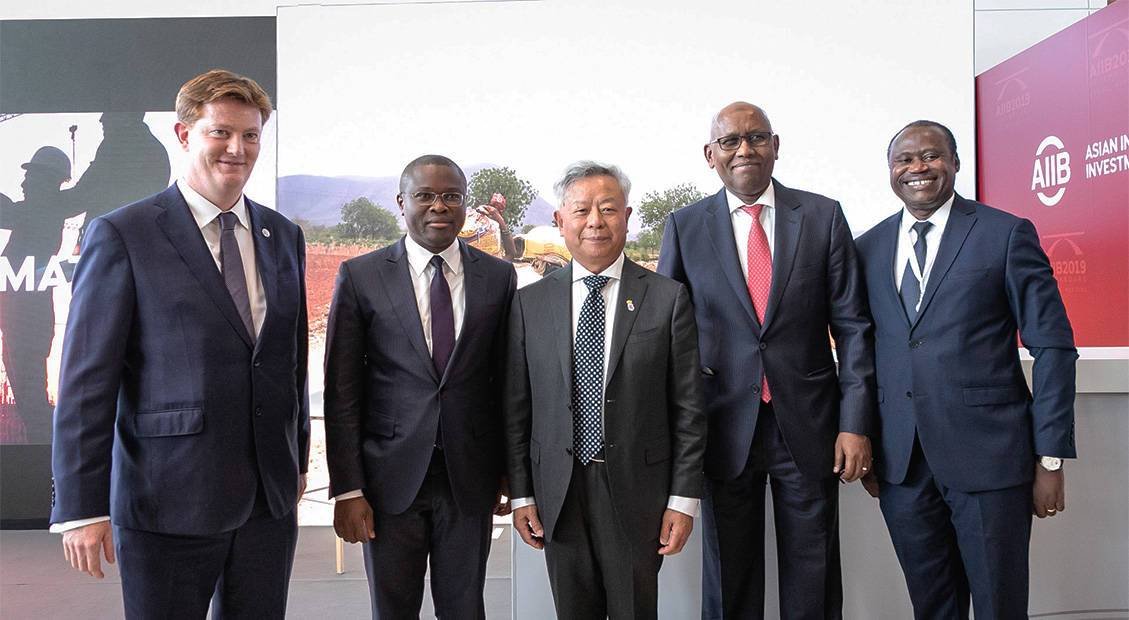

The Asian Infrastructure Investment Bank (AIIB) now has 100 approved members after its Board of Governors today supported the applications of three African countries. The milestone was reached with the addition of Benin, Djibouti and Rwanda during the Bank’s annual meeting in Luxembourg.

“AIIB members collectively account for 78 percent of the world’s population and 63 percent of global GDP. With the backing of all of our members, we are building a lean, clean, and green institution that can help to support their sustainable development,“ said AIIB President Jin Liqun.

New estimates by the African Development Bank suggest that Africa’s infrastructure needs amount to USD130–170 billion a year, with a financing gap in the range USD68–108 billion. AIIB and the African Development Bank signed a Memorandum of Understanding in April 2018 to enhance collaboration in developing programs, co-financing, and other forms of financial assistance, knowledge and staff exchanges.

The three prospective non-regional members will officially join AIIB once they complete the required domestic processes and deposit the first capital installment with the Bank.

“AIIB was created by 57 founding members as a multilateral institution focused on supporting sustainable development through infrastructure. That another 43 members have joined in the last three years is recognition that AIIB has established itself as part of the rules-based international system, with strong governance and high international standards,“ said AIIB Vice President and Corporate Secretary Sir Danny Alexander. “We now have members on every continent, and we welcome the growing interest of African countries in AIIB. We look forward to working with Benin, Djibouti and Rwanda to support their development in the years to come.”

AIIB's inaugural projects ranged from a slum upgrading project in Indonesia to a new pipeline linking gas fields in Azerbaijan to markets in southern Europe, via Türkiye.

To date, 45 projects in 18 member countries totaling USD8.5 billion have been approved.

AIIB’s Board of Governors approved the resolution welcoming the three prospective African members during the Bank’s fourth Annual Meeting in Luxembourg.

Visit aiib.org/annualmeeting to view the Annual Meeting program and to watch live streaming from the event.

About AIIB

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank with a mission to improve social and economic outcomes in Asia. Headquartered in Beijing, we began operations in January 2016 and have now grown to 100 approved members worldwide. By investing in sustainable infrastructure and other productive sectors in Asia and beyond, we will better connect people, services and markets that over time will impact the lives of billions and build a better future.

Beijing, February 12, 2026

AIIB and Kazakhstan Sign Partnership Framework Agreement to Support Infrastructure Investment

AIIB and the Government of Kazakhstan sign a Partnership Framework Agreement to enable sovereign-backed infrastructure investment and support priority projects aligned with national development goals.

READ MOREBeijing, February 11, 2026

AIIB Makes Follow-on Investment in Keppel Private Credit Fund III

AIIB announces a USD75.5 million follow-on investment in Keppel Private Credit Fund III, strengthening its strategic partnership with Keppel to support sustainable infrastructure and private credit markets across Asia-Pacific.

READ MOREBeijing, February 09, 2026

AIIB Launches ASEAN Connectivity Day in Malaysia, Advancing Cross-Border Energy Connectivity and Private Capital Mobilization

AIIB launches its inaugural ASEAN Connectivity Day in Malaysia, advancing cross border energy connectivity, renewable investment, and private capital mobilization.

READ MOREHong Kong, China, January 26, 2026

AIIB President Zou Jiayi Calls for Stronger Multilateral Cooperation to Sustain Investment Amid Global Economic Uncertainty

Speaking at the 2026 Asian Financial Forum today, Asian Infrastructure Investment Bank (AIIB) President Zou Jiayi highlighted the importance of multilateral cooperation to sustain long‑term investment and support shared growth amid rising global economic uncertainty.

READ MORE